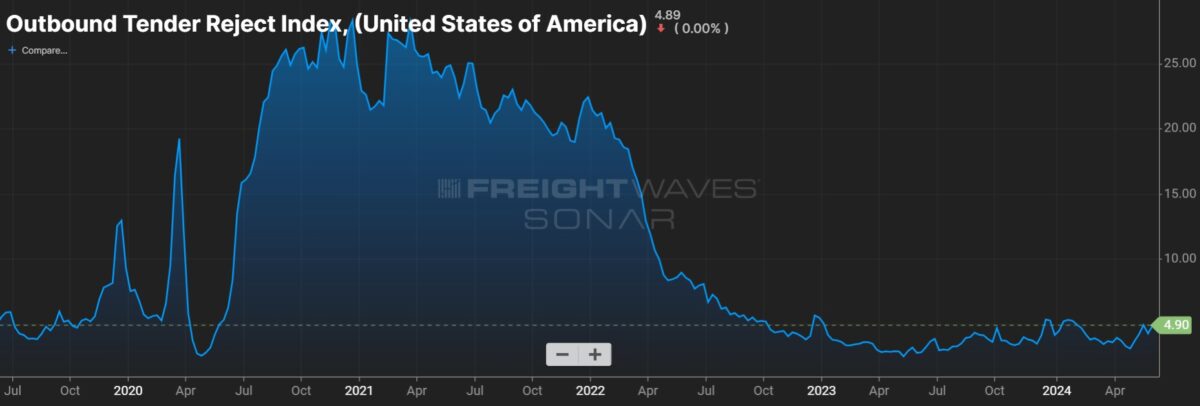

The truckload industry’s downturn is “closer to the end than the beginning,” Derek Leathers, Werner Enterprises’ chairman and CEO, told investors Tuesday at the Wells Fargo Industrials Conference in Chicago. He’s encouraged that spot rates held the uptick from May’s International Roadcheck, when some operators parked equipment to avoid safety checks by law enforcement, but said the market still hasn’t reached an inflection point.

The company continues to see rate pressure in the current bid season, but there has been less customer turnover this year. It’s “certainly better than a year ago,” Leathers said about rate negotiations, but he noted that some bid implementations have been delayed.

“It’s not a great time to go shuffle your deck dramatically in terms of your carrier providers,” Leathers said. He believes that most shippers realize an end to a depressed rate cycle is nearing. Werner (NASDAQ: WERN) has been “pretty firm” in recent negotiations, noting it has little margin left to surrender after several years of above-normal cost inflation.

He reiterated the company’s pricing guidance but said “it’s a dogfight every day to get there.” That guide calls for revenue per truck per week in the dedicated segment to be flat to up 3% year over year in 2024 and revenue per total mile at the one-way fleet to drop 6% to 3% y/y in the first half.

Overall, Leathers sees opportunities for rate increases as the year progresses. Werner’s one-way segment has low-double-digit exposure to the spot market currently.

Higher import volumes (a reversal from large declines last year), multiple quarters of inventory “right-sizing” and a consumer spending mix of goods and services getting back to a historical balance (following a post-COVID run-up in services spending) could be positive catalysts for demand, Leathers said.

Werner also has some internal initiatives that should boost earnings when the cycle improves.

It implemented $43 million in cost savings programs last year and has an additional $40 million pegged for this year. Leathers said roughly two-thirds of the expense reductions are sustainable, with the remaining reductions likely reversed when the market turns.

The company reiterated its TL operating margin guidance of 12% to 17% throughout the cycle. The adjusted margin was just 4.7% in the first quarter. Werner estimates a 5% to 10% rate increase in the one-way segment would produce a 300-basis-point improvement in operating income.

The one-way fleet is seeing improved equipment utilization. Revenue per tractor per week was up 6% y/y in the first quarter as miles per tractor increased 11% while the unit’s truck count fell 13%. The utilization improvements are expected to produce more pronounced results in a better rate environment.

The dedicated unit has seen truck counts decline at the account level throughout the downturn (down 268 units in total during the first quarter from a peak of 5,417). As the market improves, existing accounts will begin to require additional units. Unit growth at existing accounts produces better margins versus new accounts, which have startup costs.

Gains on the sale of tractors and trailers normally accounts for 10% to 15% of Werner’s earnings. The company is achieving that threshold currently, but that’s due to overall earnings being depressed. Used equipment prices have weighed on gains, but Werner believes future emission mandates will boost used values. It also expects to see above-market returns as it leverages its proprietary fleet sales group to move the equipment.

More FreightWaves articles by Todd Maiden