Last week, I upgraded my backpack to a leather tote bag. I grew tired of carrying a backpack in professional settings and wanted something of higher quality that could last for years if properly cared for. I explored The RealReal, a resale marketplace for clothing, accessories, and bags. This was my first time using the service, and I was very pleased with both the process and my new bag.

Last week, I upgraded my backpack to a leather tote bag. I grew tired of carrying a backpack in professional settings and wanted something of higher quality that could last for years if properly cared for. I explored The RealReal, a resale marketplace for clothing, accessories, and bags. This was my first time using the service, and I was very pleased with both the process and my new bag.

I mention this because The RealReal prides itself on sustainability, product authentication, and ease of use. Founded in 2011, the company has raised over $600 million in seed funding. While it has yet to turn a profit, its strong business fundamentals suggest it will stand the test of time. With advancements in authentication software and technology, companies that resell products to consumers can reduce costs associated with hands-on validation.

Companies like The RealReal are exactly what today’s consumers, particularly younger ones, are looking for. They provide broader access to high-quality brands for those who may not be able to afford new items at full price. Additionally, resale marketplaces offer valuable exposure to smaller brands or those not typically marketed to certain demographics. Most importantly, it’s sustainable. The RealReal transforms items that might otherwise be collecting dust in a closet into something valuable, giving them a second life. This not only gets the product back into use but also reduces the resources that would have been needed to create a new product.

Now let’s get into this week’s news in Supply Chain & Logistics!

UPS Introduces New “Surge Fee” for China to US Imports

UPS announced that starting September 15th, it will charge a per-pound charge on all U.S. imports from China and several other countries. Ten countries, including Australia, Japan, South Korea, Indonesia, Malaysia, Philippines, Singapore, Taiwan, Thailand, and Vietnam, will have a $0.25 per pound “Surge Fee” applied to shipments headed to the U.S. A $.50 per pound charge will apply to shipments from China, Hong Kong, and Macau. UPS and other parcel carriers are grappling with a flood of packages coming from Asia-based e-commerce marketplaces like Temu and Shein. FedEx hasn’t announced a directly comparable fee yet, it recently implemented a $.25 per pound import demand surcharge on Aug.5 for parcel shipments from China, Hong Kong, and the Philippines into the U.S. The minimum charge is $1 per shipment.

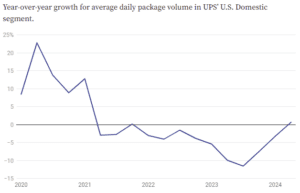

UPS Grows U.S Volume For First Time Since Q4 2021

Over two years of sagging volume, UPS overcame its lagging demand in Q2 of 2024. The average U.S. volume went up .7% year over year in Q2. This jump was supported by the interest in its competitive SurePost service and booming e-commerce companies that operate with a different shipping model than traditional UPS users. CEO Carol Tome mentioned two new e-commerce customers that came into the network whose volumes are “explosive.” Temu and Shein were not outright mentioned in the earnings call but both companies utilize UPS services and they are driving the carrier’s surge in lightweight volume. In July, the e-commerce marketplaces each provided carriers with about 900,000 packages daily in the U.S., according to ShipMatrix. Low value volume is what is currently covering costs at major carriers, there are more lucrative sectors but the wave of low-cost e-commerce packages keeps trucks full and delivery routes busy.

Over two years of sagging volume, UPS overcame its lagging demand in Q2 of 2024. The average U.S. volume went up .7% year over year in Q2. This jump was supported by the interest in its competitive SurePost service and booming e-commerce companies that operate with a different shipping model than traditional UPS users. CEO Carol Tome mentioned two new e-commerce customers that came into the network whose volumes are “explosive.” Temu and Shein were not outright mentioned in the earnings call but both companies utilize UPS services and they are driving the carrier’s surge in lightweight volume. In July, the e-commerce marketplaces each provided carriers with about 900,000 packages daily in the U.S., according to ShipMatrix. Low value volume is what is currently covering costs at major carriers, there are more lucrative sectors but the wave of low-cost e-commerce packages keeps trucks full and delivery routes busy.

China endures worst heat waves in 6 decades, halting factories to conserve energy

China is facing its harshest heat wave in six decades, with temperatures breaching 40 degrees Celsius (104 degrees Fahrenheit) in dozens of cities. The extreme and elongated heat waves have caused a spike in demand for air conditioning, putting additional pressure on the power grid. Sichuan, one of China’s largest provinces with 84 million people, told 19 out of 21 cities in the region to suspend production at all factories from Monday to Saturday. Sichuan is a key manufacturing location for the semiconductor and solar panel industries and the power rationing will hit factories belonging to some of the world’s biggest electronic companies including Apple supplier Foxconn. The southwestern province which is also a key hydropower hub in China has been gripped with heat and drought since July, causing a 51% drop in rainfall affecting power production.

Target Continues to Invest in Their Supply Chain Network with Additional Sortation Facility

Target is opening the doors of its newest sprtation center in the Detroit area, the 11th one in the company’s network. The facility has a smaller-than-average footprint and is expected to serve more than 3 million customers in the market and process up to 60,000 packages daily by 2028. This location in particular will also receive a volume of packages from its neighbor location in Chicago, increasing the next-day delivery market for the surrounding areas. The addition of Detroit advances Target’s previously announced $100 million investment to grow its sortation center footprint to more than 15 facilities by the end of 2026. The company is not shying away from further supply chain spending. Next year, it plans to start investing up to $5.5 billion annually “to deepen capabilities across the business, including our supply chain network,” the company said in its fact sheet.

Train Stoppage Partially Ends and Rail Workers Begin Returning to Work

Last week, the major railroad companies and unions in Canada ordered a work stoppage after labor negotiations failed. Employees at one of Canada’s major railways will return to work after the federal government intervened to end a brief work stoppage involving the Canadian National Railway (CN) and Canadian Pacific Kansas City (CPKC). The stoppage began after 9,300 workers were locked out due to failed negotiations with the Teamsters union. The Canadian government ordered binding arbitration and directed the Canada Industrial Relations Board (CIRB) to settle the disputes, ensuring that railway operations resumed to avoid disrupting supply chains. While CN is resuming operations, the work stoppage at CPKC continues pending a CIRB order. The union criticized the government’s decision to impose binding arbitration, vowing to challenge its constitutionality.

Song of the Week: