Growers are reporting heavier plantings in Northern Florida, Georgia, and Indiana this year, which means the season could run through September when the fall crops start. Due to adverse weather, the season will also come into one with a very light supply out of Mexico, Guatemala, Costa Rica, and Honduras. For reefer carriers, especially those in Florida and Arizona, a strong watermelon season supports higher spot rates as demand rises in the weeks leading up to July 4 celebrations, when shipment volumes typically peak.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

In a remarkable turn of events, watermelons have surged ahead to dominate national truckload tonnage in the past 30 days, a position typically held by potatoes. Watermelon production in Florida is 11% higher y/y, accounting for 53% of watermelon shipments last week. Mexico (34% of volume) is next, with production 17% ahead of last year. Texas accounted for 13% of loads last week, reporting 19% higher volume. This trend is expected to continue as the Florida season peaks, followed by increased production in Georgia, California, Indiana, and North Carolina in the subsequent months.

According to the USDA, Mexico is also a large watermelon supplier, with around 62% of shipments crossing into the U.S. via Nogales, AZ, in the Tucson freight market, followed by Progreso, TX, in the Rio Grande Valley region and McAllen freight market.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

This time last year, outbound linehaul rates in the Fresno produce market averaged $2.59/mile, $0.07/mile higher than last week’s market average of $2.52/mile on an 8% lower volume w/w and y/y. The USDA reported an adequate supply of reefer trucks on flat volumes in California last week despite shipments being close to 10% lower than last year. Fresno to Hunts Point, NY, paid carriers an average of $6,560/load last week, almost $500/load or 8% higher than last year.

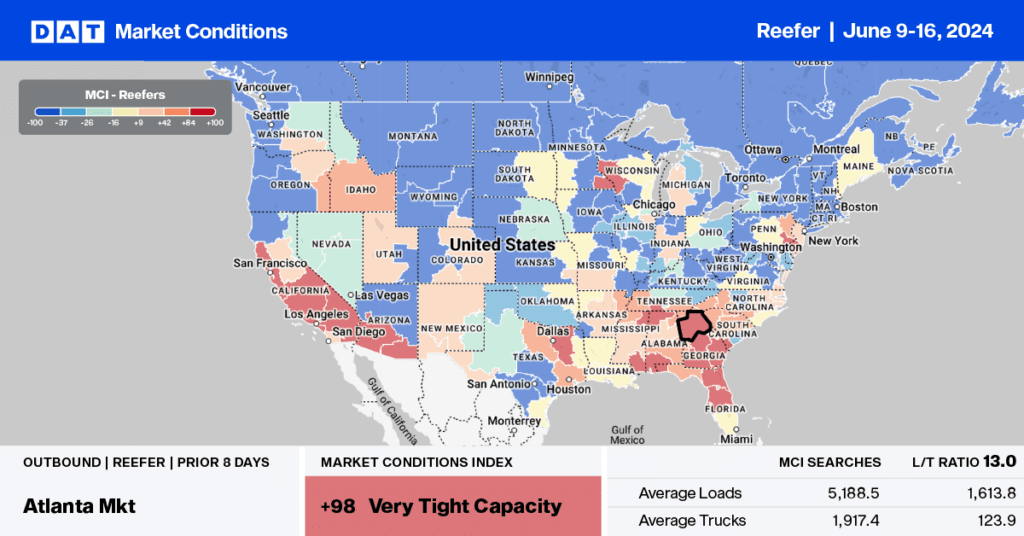

In southern Georgia, where the peach season has started, volumes are 30% lower than last year, according to the USDA, while in Florida, volumes are surging, boosted by a strong watermelon season. At $2.44/mile, Georgia outbound reefer rates have been flat for almost a month but are tracking around $0.05/mile higher y/y. In the large Tifton produce market, linehaul rates dropped $0.03/mile last week to $2.44/mile on a 10% higher volume.

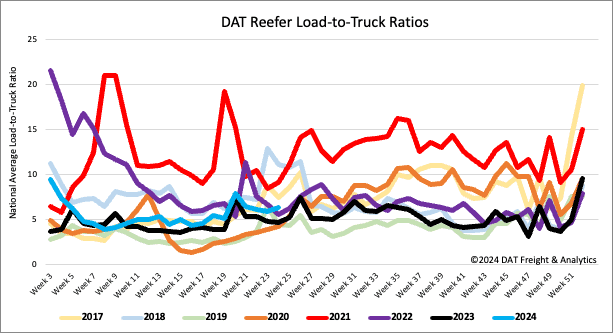

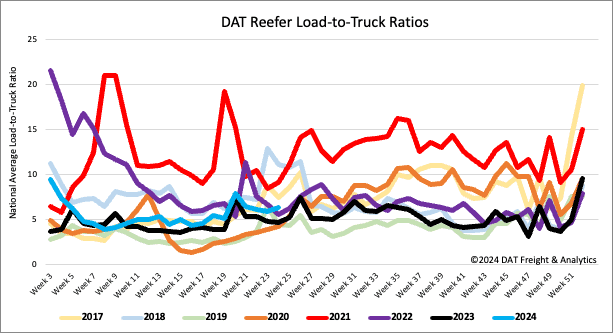

Load-to-Truck Ratio

Reefer load post volumes decreased by 1% last week and 2% year-over-year (y/y). Compared to non-pandemic-influenced years going back to 2017, last week’s average is 6% lower. Carrier equipment posts were 8% lower last week, increasing the reefer load-to-truck ratio by 8% w/w to 6.31.

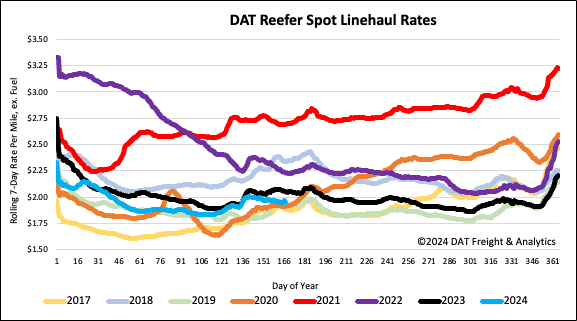

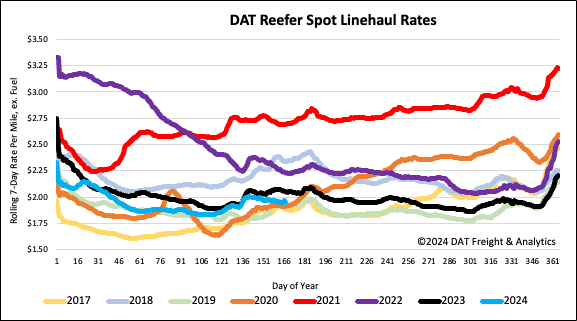

Spot rates

The national average reefer linehaul rate has remained flat for the last three weeks, averaging $1.97/mile. At this level, reefer linehaul rates are $0.10/mile lower on a 9% lower volume of loads moved than Week 24 last year.