California is the leading producer of grapes in the United States by a significant margin. The state is renowned for its vast vineyards, which thrive in its Mediterranean-like climate. California accounts for nearly 90% of the nation’s grape production, with regions like Napa Valley, Sonoma, and the Central Valley particularly famous for their vineyards. The grape harvest season varies depending on the type of grape and the region. Still, it generally falls between late summer and early fall, particularly from July to November for table grapes.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

California grapes are shipped both domestically and internationally, serving a wide variety of markets. Approximately 35% of California’s grape production is exported, with the rest distributed across the United States, supplying supermarkets, grocery stores, farmers’ markets, and wholesale distributors in all 50 states. Major export destinations include Canada, Mexico, Central America, Asia (China, Japan, South Korea, and Hong Kong are significant buyers of fresh grapes and wine), and Europe.

According to the USDA, domestic truckload shipments of grapes were around 12% higher than last year at the start of October and at the highest level in five years. The states that consume the most California grapes typically have large populations and significant demand for fresh produce. The top consumers of California grapes include California, New York, Texas, Florida, and Illinois (particularly in the Chicago metropolitan area).

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

This week, we focus on the Rio Grande Valley (RGV) in southern Texas in the McAllen freight market, a highly productive agricultural region known for its diverse crop output. The region’s warm climate and rich soils make it ideal for growing crops year-round, including citrus fruits, vegetables, cotton, and sugarcane. The RGV is one of Texas’s largest producers of citrus fruits, particularly grapefruits and oranges. Over 90% of Texas’ citrus comes from this region. The region can produce hundreds of millions of pounds of citrus fruits in peak years annually.

The Valley produces many Texas vegetables, including onions, tomatoes, cabbages, and leafy greens. The RGV is known for its large onion production, reaching 300-400 million pounds per season. The RGV is also one of the largest cotton-producing areas in Texas, often contributing more than 1 million bales of cotton annually. The region is also home to Texas’ only sugarcane farming, which typically spans over 40,000 acres and produces significant amounts of sugar for domestic and export markets.

The recent executive order by Texas Agriculture Commissioner Sid Miller, giving Texas farmers and ranchers the green light to tap into the Rio Grande for irrigation, is boosting farmer sentiment. The recent heavy rains in Mexico have caused significant runoff from the reservoir Marte Gomez, and too much water is being wasted by flowing into the Gulf of Mexico.

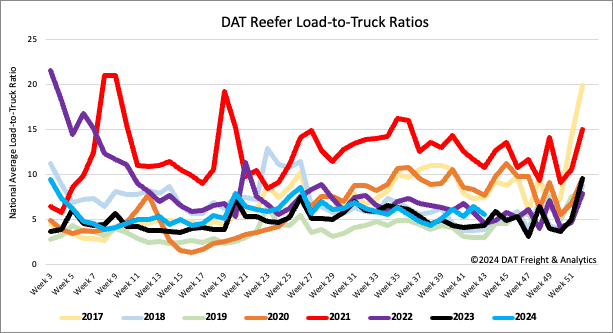

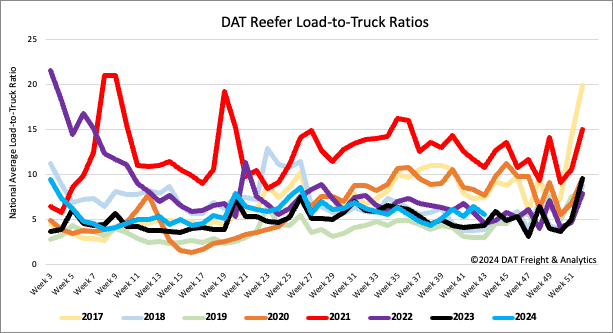

Load-to-Truck Ratio

Following a surge in volume the previous week, national reefer load postings dropped by 15% last week, but they are still 6% higher than last year. This decrease was partly due to an 8% drop in USDA produce volumes in California compared to the previous week. However, postings for carrier equipment mainly remained unchanged, resulting in a 15% increase in the reefer load-to-truck ratio (LTR), which now stands at 5.53.

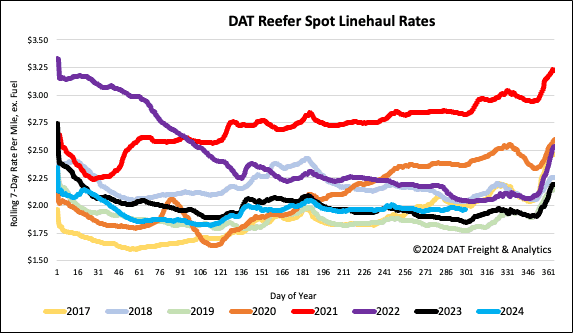

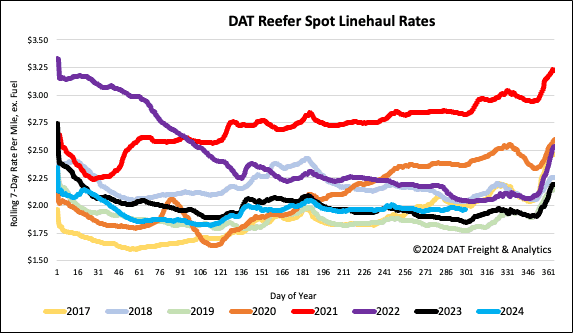

Spot rates

Weaker volumes led to a decrease in the national average reefer linehaul rate, which fell by $0.01 per mile last week. Carriers were paid an average of $1.98 per mile, which is $0.11 per mile higher than last year. The number of loads moved declined by 4% week-over-week, remained flat compared to last month, and was approximately 3% higher than the same time last year. Notably, Baltimore reported solid gains in winter produce last week, as imports from South America began to arrive. As a result, reefer linehaul rates for outbound loads surged by $0.17 per mile, reaching a market average of $2.36 per mile on a 14% increase in volume.