The National Restaurant Association’s Restaurant Performance Index (RPI) remained below 100 in contraction territory in May. However, with a slight increase from April’s 98.8 to 99.1, there is potential for growth. Index values above 100 indicate that key industry indicators are expanding, while index values below 100 represent a period of contraction. Excluding the pandemic when the RPI dipped to 95, the May reading is the lowest since 2010.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The Expectations Index, which measures restaurant operators’ six-month outlook for four industry indicators (same-store sales, employees, capital expenditures, and business conditions) stood at 99.6 in May, up slightly from 99.5 last month. Restaurant operators remain uncertain about sales and the economy in the months ahead.

In May, restaurant operators reported net declines in same-store sales and customer traffic, continuing a soft patch that began early in 2024. Their outlook for sales is mixed, while their economic expectations remain generally pessimistic.

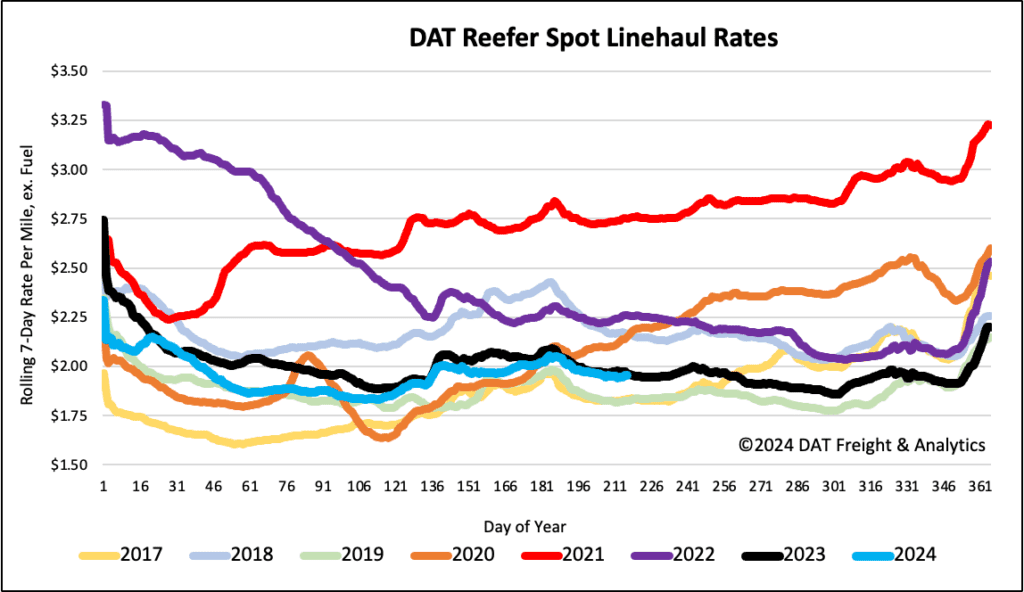

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

California typically contributes about 40% of the national produce truckload volume in August, making it a dominant market for refrigerated (reefer) volume. The top produce in the state is lettuce and strawberries (accounting for 32% of loads last week) grown primarily in the Salinas/Watsonville area of the San Francisco freight market. Volumes for these products were up 2% and 1% last week, respectively according to the USDA.

Outbound reefer capacity was tight, and linehaul rates increased by $0.02/mile to $2.38/mile due to a 4% rise in volume. On the primary outbound regional lane heading south to Los Angeles, reefer spot rates rose by $0.07/mile to $2.61/mile with a 7% increase in volume last week on on a 4% higher volume. On the number one outbound regional lane south to Los Angeles, reefer spot rates were up $0.07/mile to $2.61/mile on a 7% higher volume last week.

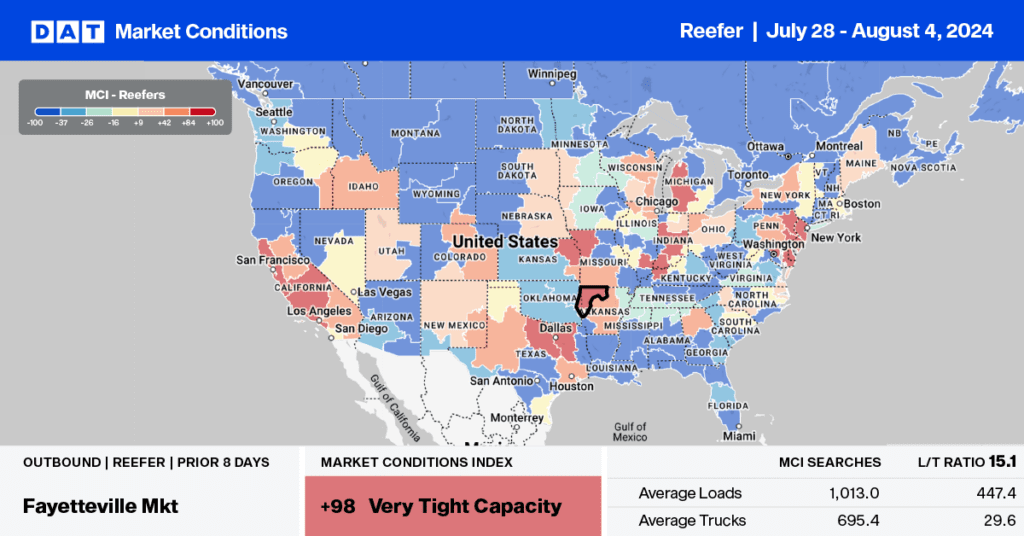

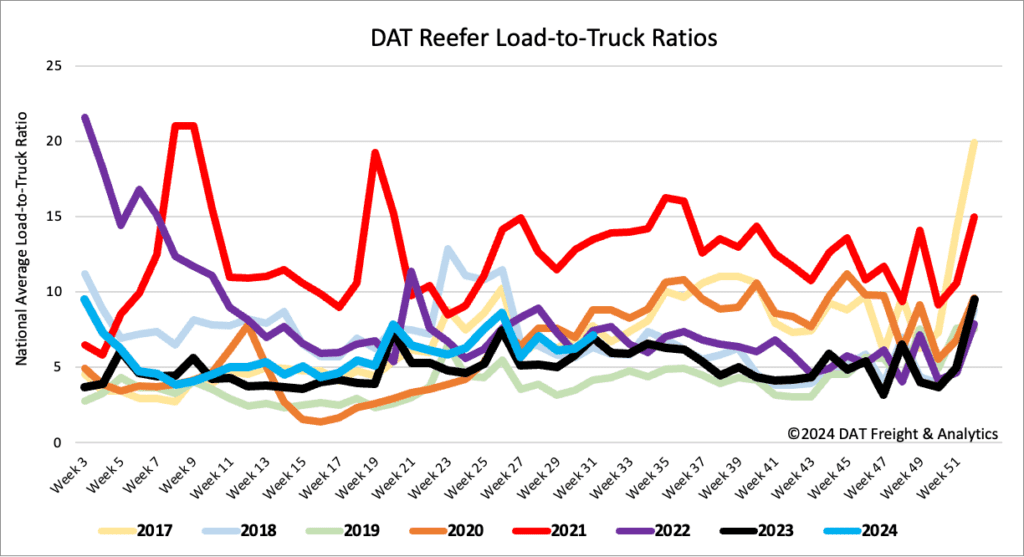

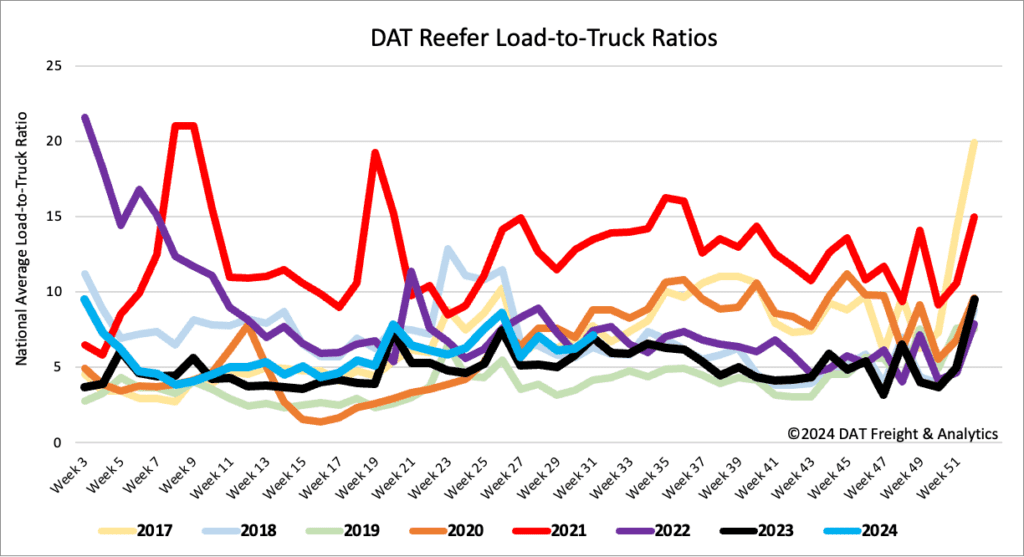

Load-to-Truck ratio

The volume of reefer load postings was primarily flat last week and remains 21% lower than last year. According to the USDA, truckload produce volumes last week were 2% lower than last year, with California’s volume down 9% year over year. Carrier equipment posts were 11% lower last week and 22% lower year over year, leading to a 14% increase in the reefer load-to-truck ratio (LTR) to 7.12.

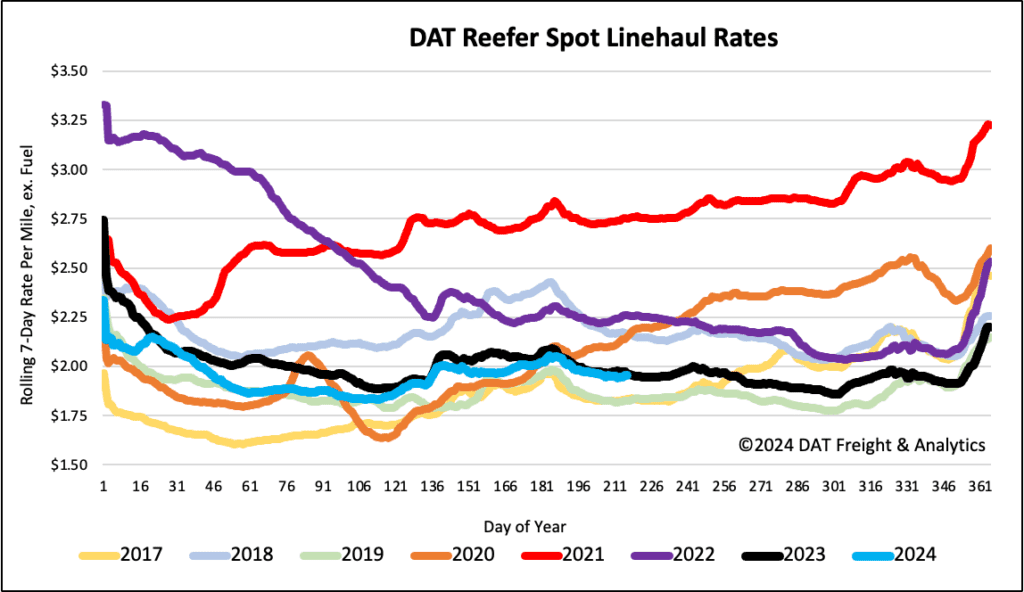

Spot rates

The national average reefer linehaul regained some of the prior week’s $0.05/mile loss, increasing by almost $0.02/mile last week. At just under $1.97/mile, reefer linehaul rates were almost identical to last year and $0.01/mile lower than the 3-month trailing average.