For the first time in many months, the Pacific Northwest (PNW) report a slight surplus of trucks following last week’s 1% week-over-week (w/w) increase in produce volume. The PNW has had a solid season, with apple, pears, potatoes, and onion volumes 18% higher than last year. According to the USDA, there was a slight shortage of trucks to load produce in south and central Florida last week, the only market to report a shortage out of the 18 growing regions tracked nationally.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Florida produce volumes typically peak mid to late May each year, so there’s plenty of time to catch up, but as of last week, volumes are flat y/y. Tomatoes are the number one commodity being shipped at the moment, accounting for 24% of the year-to-date (YTD) total, followed by strawberries (20%) and cabbage (12%). Tomato volumes are around 2% lower than last year, while strawberry shipments are 72% higher as that season winds down following the early March seasonal peak.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

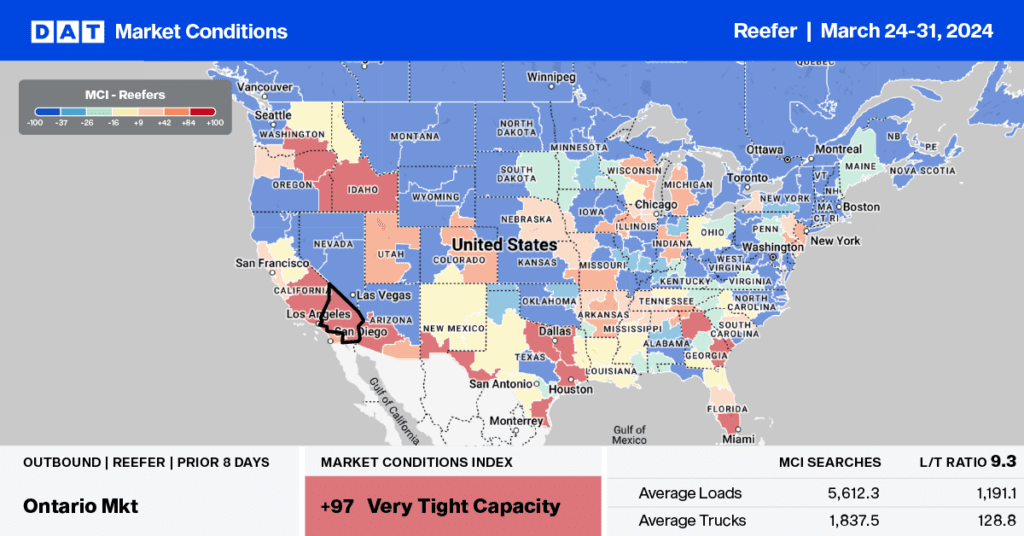

As the produce season passes the peak, available reefer capacity continues to loosen in the Pacific Northwest (PNW) following last week’s 1% decrease in outbound linehaul rates. Regional volumes were impacted the most by the 23% increase in loads moved in the Twin Falls, ID market, where linehaul rates decreased by $0.04/mile to $2.15/mile for outbound lanes. In the larger Washington market, loads moved increased by 1% w/w, while spot rates dropped by $0.02/mile to $1.84/mile.

Loads from Spokane to Los Angeles paid carriers an average of $1.47/mile, down $0.13/mile last week but $0.12/mile higher than last year. At $1.85/mile, loads from Twin Falls to Los Angeles are paying around $0.10/mile lower than last year and $0.71/mile lower than the late February shipping peak of $2.56/mile.

In California’s large Fresno produce market, the season is just starting following last week’s 14% increase in loads moved, pushing up reefer linehaul rates by $0.04/mile to $2.14/mile.

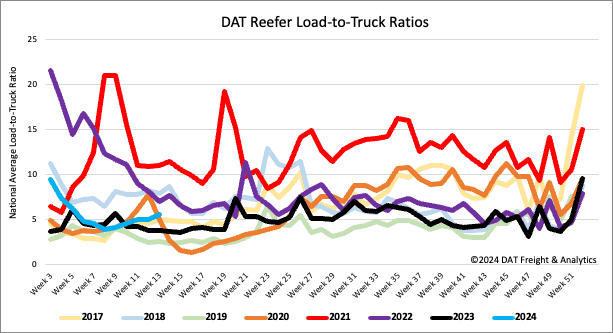

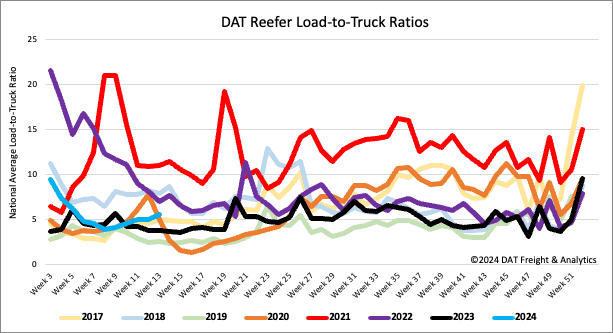

Load-to-Truck Ratio

Reefer load post volume decreased following last week’s 2% slide but ended the week 1% higher than last year as the produce season started to impact the reefer spot market. According to the USDA, truckload produce volumes are 3% higher than last year after a very slow start to the season. Available capacity decreased following last week’s 11% drop in equipment posts, increasing the load-to-truck ratio by 11% to 5.53.

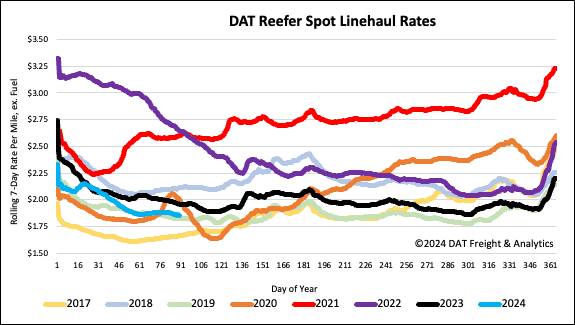

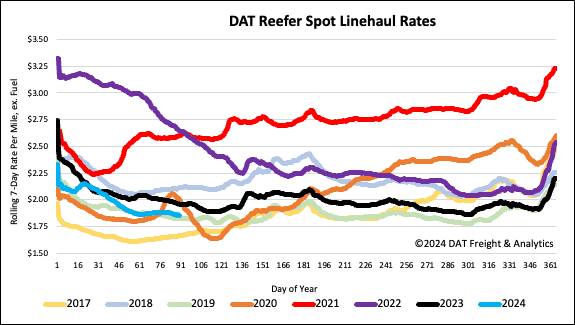

Spot rates

After being primarily flat for a month, reefer spot rates decreased by just over $0.02/mile last week, even though the national volume of loads moved was up by just over 12%. At $1.88/mile, reefer linehaul rates are $0.11/mile lower and $0.03/mile higher than in 2019.