The cherry season in California, a crucial period for the agricultural industry, has already begun its peak which will stretch into mid to late June. This intense period lasts for a mere six weeks, contributing a significant 22% to the national annual volume.

The heart of this production is Lodi, CA, in the Stockton freight market, where the renowned Bing cherry variety thrives due to the ideal climate. California Cherries reports that this region benefits from cold winter temperatures and warm, but not excessively hot, temperatures in the spring and summer months.

According to Michael Marks, host of “What’s In Season with Michael Marks” live on CBS News Sacramento, “At this time of the year, cherries go from immature to and fully ripe really quickly, but the last thing cherries need this time of year is rain. Growers are fortunate because that rain blew last week, followed by cool winds helping dry out the cherry orchards from Bakersfield north to Lodi. They not only dry out the orchards but also dry out the cherries themselves. Cherries are what I call a fruit that lives in the fast lane. They grow fast, they harvest fast, they go bad fast.”

For reefer carriers, the cherry season poses unique challenges. As cherries ripen on the tree and have an extremely short shelf life, transit schedules become very tight. The cherries must be transported quickly and with utmost care to minimize damage. This season, carriers must also ensure they have adequate cargo insurance.

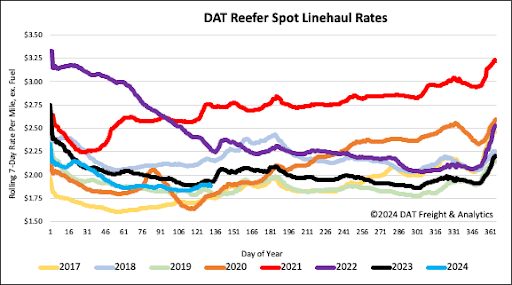

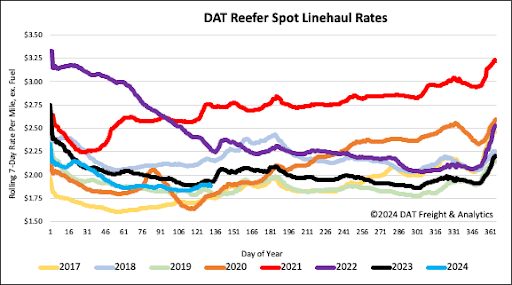

All rates cited below exclude fuel surcharges unless otherwise noted.

Mother’s Day floral shipments out of Miami and a record weekly shipment of strawberries in California boosted spot market demand last week. The state hit a volume record of over 9.8 million trays of strawberries, or the equivalent of 2,300 truckloads. Strawberry volumes are up 29% yearly, almost equal to lettuce load volume. The last time California hit even close to that was in 2018 at 9.7 million trays in late May.

In the San Francisco market, where most strawberries are grown, outbound reefer linehaul rates increased by $0.06/mile to $2.18/mile on a 5% higher w/w volume of loads moved. Regional loads to Los Angeles were up $0.15/mile w/w to $2.25/mile on a 15% higher volume of loads moved.

Outbound linehaul rates in the Fresno market have steadily increased since the start of March, averaging $2.20/mile last week as the produce season gets underway. Fresno to Phoenix loads paid carriers an average of $2.39/mile last week, up $0.09/mile w/w but still $0.20/mile lower than last May’s average of $2.59/mile. Ratecast has rates ending May around $0.09/mile lower than last year at $2.50/mile on this lane. Seattle loads averaged $2.46/mile, around $0.30/mile lower than last year.

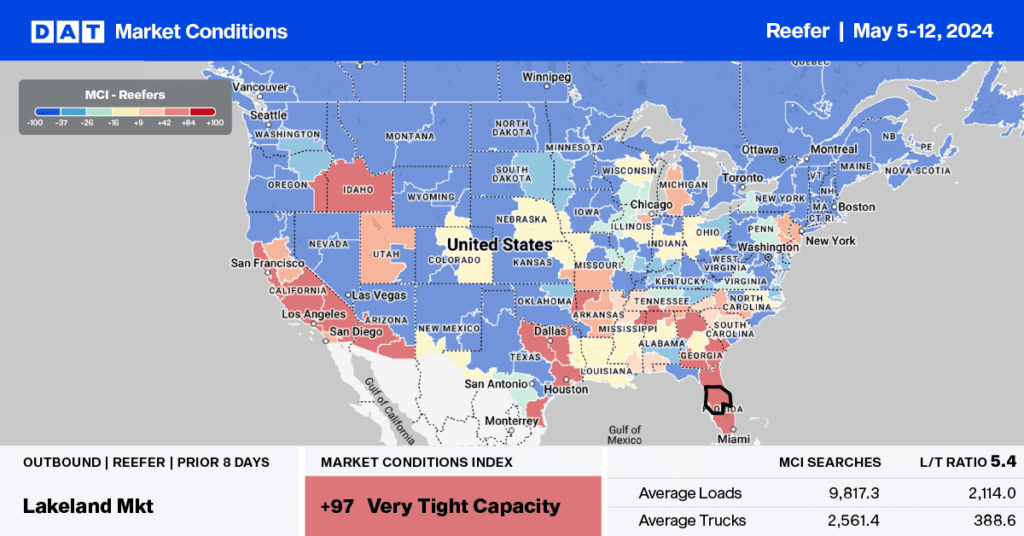

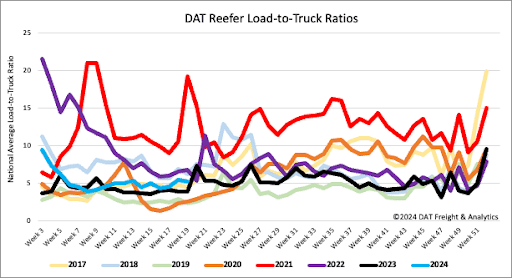

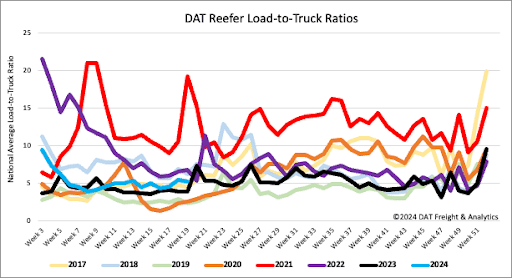

Following the prior week’s surge in volume as shippers positioned inventory in markets two weeks ahead of Mother’s Day, load post volumes eased following last week’s 7% decrease. Available capacity decreased as produce seasonality emerged, with equipment posts decreasing by 4% w/w, resulting in the reefer load-to-truck ratio dropping slightly to 5.26.

National reefer linehaul rates were up for the third week following last week’s $0.02/mile gain. At $1.91/mile, reefer linehaul rates are $0.05/mile lower on a 5% lower volume of loads moved than last year.