Typically, the season sees the first fruits ripening by the end of April, with shipments wrapping up by mid to late June, and winds down quickly after contributing around 22% to the national annual volume in a very short 6-week season. Nearly all of the cherry production is centered around Lodi, CA, in the Stockton freight market where the famous Bing cherry variety is grown because of the ideal climate that provides cold winter temperatures and warm, but not too hot, temperatures in the spring and summer months, according to California Cherries.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Following the California season, cherry production switches to the Pacific Northwest (PNW), where volume from Washington State is just starting to come online. Last year was different, though, with a slower start to the California season resulting in shipments extending right up to the July 4 long weekend, which overlapped with the PNW season.

Despite another wet winter with numerous “atmospheric rivers,” the 2024 California cherry season aligns more with historical norms and a shorter harvest. According to Mark Calder of Primavera Marketing, “This year, we are seeing a return to a more typical seasonal calendar. Early varieties are expected to debut around April 25, with steady volume projected for the southern San Joaquin Valley by May 5,” says Calder. “Things appear to be on track this year,” says Dave Martin of Stemilt Growers. “The Coral variety is expected to peak between May 10 and 25, followed by Bing between May 25 and June 10.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

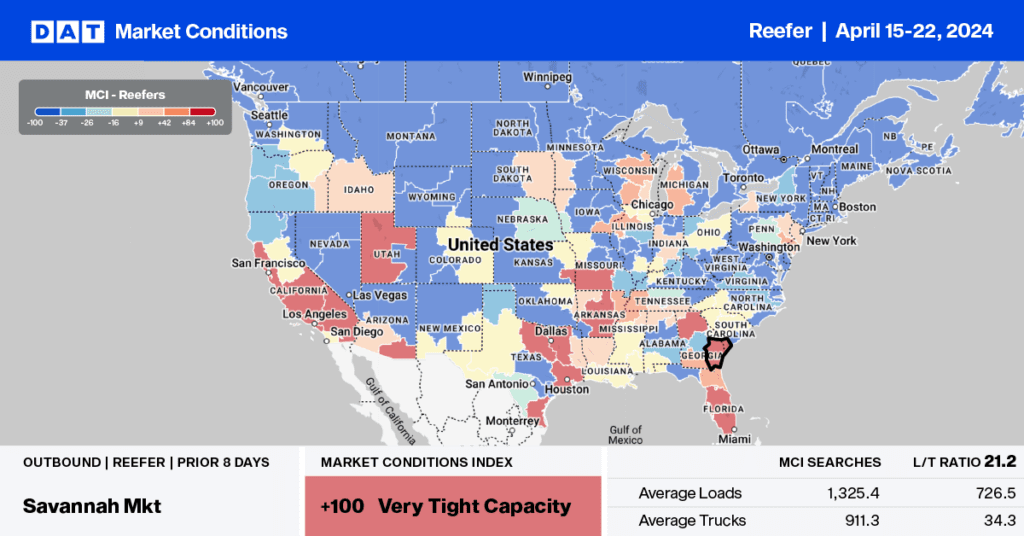

According to the USDA, capacity is tightening in Florida ahead of Mother’s Day and in Nogales, AZ, in the Tucson freight market. The USDA reported a slight shortage of trucks last week in both regions for truckloads of vegetables from Mexico to Chicago and South Florida to Boston and New York. Lakeland, FL, to Boston, paid carriers on average $1.77/mile last week, the highest since last July but almost $0.22/mile lower than last year. Capacity was much tighter on the New York lane, where rates were $0.30/mile higher than the March average at $2.01/mile, also the highest since last July. Florida state average rates jumped $0.12/mile last week to $1.53/mile.

In south Texas, where most (40%) Mexican produce crosses into the U.S. in McAllen, produce volumes were up 8% w/w and 1% y/y as the Mexican market approaches the mid-May season peak. The volume of reefer loads moved was up 4% w/w and 33% y/y, but with sufficient available capacity, linehaul rates were mainly flat to down slightly, averaging $2.08/mile. Loads from McAllen to Dallas paid carriers $2.59/mile, down $0.22/mile w/w after increasing for the last eight months, while loads east to Orlando averaged $2.39/mile, up $0.03/mile w/w on a 4% higher volume of loads moved.

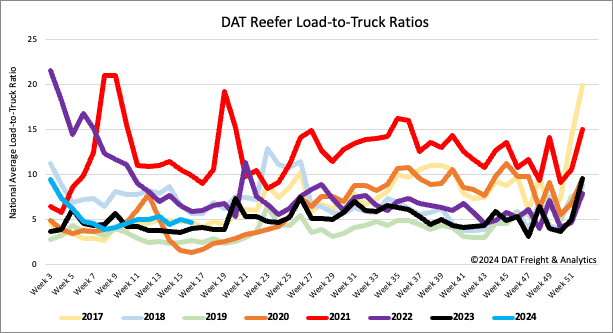

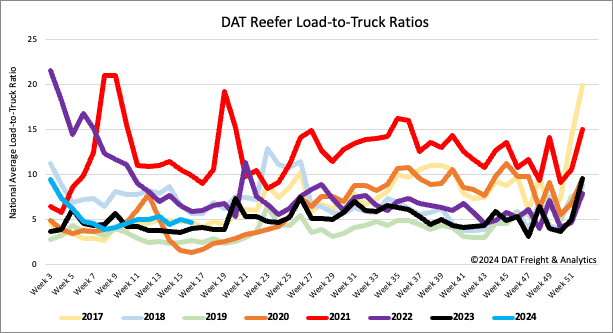

Load-to-Truck Ratio

Reefer load post volume also lost ground following last week’s 8% week-over-week (w/w) decrease, almost the exact week-over-week change as last year. Equipment posts reversed course, increasing by 3% w/w, resulting in the reefer load-to-truck ratio decreasing by 8% w/w to 4.64.

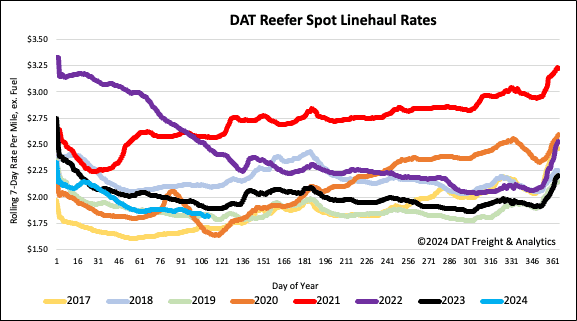

Spot rates

Reefer spot rates dropped a penny per mile for the second week to a national average of $1.85/mile. Reefer linehaul rates are $0.07/mile lower and $0.02/mile higher than in 2019.