Weekly highlights

Asia-US West Coast prices (FBX01 Weekly) fell 1% to $4,754/FEU.

Asia-US East Coast prices (FBX03 Weekly) fell 1% to $6,652/FEU.

Asia-N. Europe prices (FBX11 Weekly) fell 1% to $4,501/FEU.

Asia-Mediterranean prices (FBX13 Weekly) fell 5% to $4,972/FEU.

China – N. America weekly prices increased 4% to $4.99/kg

China – N. Europe weekly prices fell 20% to $2.2/kg.

N. Europe – N. America weekly prices fell 1% to $2/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Many of the world’s top ocean freight stakeholders are gathered in Long Beach this week for the annual TPM conference, which this year takes place under the shadow of continued Red Sea disruptions.

The conference commenced alongside news of another container ship hit by a missile strike, and new developments in the saga, including the first sunk vessel, and Houthi demands that ships obtain a permit from the rebel group in order to transit Yemeni waters.

The former CIA chief, Robert Gates, speculated that the Houthis may keep up their attacks even if an Israel – Hamas ceasefire develops, while overall the tone has been of an industry adjusting to a new normal.

In terms of freight rates, consensus from shippers here seems to be that the January and February surcharges and rate increases were exaggerated but were also – for the most part – accepted, as there was so much uncertainty during the first weeks of the diversions, so much work to be done by the carriers to make adjustments, and additional urgency as diversions hit just weeks before Lunar New Year.

But ocean freight is now entering its slow season, and carriers by now have also had time to make adjustments. So shippers also agree – especially given that rate increases far exceed most estimates of additional costs faced by carriers – that now rates need to come down from recent highs.

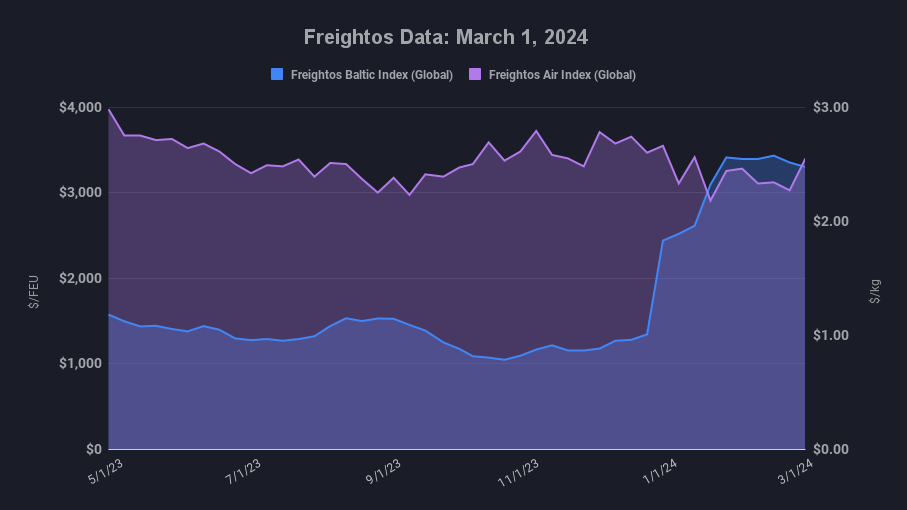

Freight rates on the major routes were stable overall last week, but, indeed, with the immediate post-Lunar New Year period and any holiday backlog behind us, rates so far this week look set to continue to fall on the Asia – N. Europe and Mediterranean lanes, and prices from Asia to N. America have begun to decline meaningfully as well.

Though some carriers have announced April GRIs and surcharges on some secondary lanes, the knock-on effects on non-Red Sea lanes look to be waning too as prices on the transatlantic fell 8% last week to about $1,700/FEU.

The threat of a potential ILA port worker strike at East Coast and Gulf ports in October is also a topic of concern at this year’s TPM. And though most observers are optimistic that the dispute will be resolved without a labor disruption, some shift of volumes to the West Coast or pull forward of some peak season containers to Q3 are also possibilities.

In air cargo, some hubs did register increases in volumes as a result of Red Sea disruptions and LNY pushing some shipments to air in February. But rate level increases were not extreme even at this likely peak of increased demand, and prices overall have been easing in late February and into March.

In terms of air cargo labor, repeated strikes by ver.di union cargo handlers have disrupted Lufthansa’s operations in Germany recently. As a result, Lufthansa has agreed to further negotiations soon.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.