The air cargo industry is undergoing significant growth due to the rapid expansion of e-commerce, leading to an increased demand for freighter aircraft. Passenger-to-freighter (P2F) conversions have become a popular solution to meet this demand. Airbus forecasts a 4.7% annual growth rate for the air cargo market over the next 20 years, indicating a need for approximately 2,440 freighters, including 880 new builds.

What’s fuelling this massive demand for freighter aircraft?In a recent interview with The STAT Trade Times, Nadeem Sultan, Senior Vice President of Freighters & Cargo Planning at Emirates, said, “The freighter fleet and the main deck capacity has been challenged primarily because of well-documented delays in delivery of new freighter aircraft. On average, we see a delay of four to six months. We have our orders from Boeing outstanding. To mitigate the impact of those delays on our growth plans and commitment, we are now flying three leased 747s on ACMI. In addition, we have 11 B777 freighters, and we are also looking to add two more on ACMI.” Sultan added that there is a waiting time of around four to five years to purchase a new production freighter.

“We, at Emirates, are seeing that cargo volumes are continuing to grow.”

Nadeem Sultan, Emirates

“We, at Emirates, are seeing that cargo volumes are continuing to grow,” said Sultan. Talking about factors fuelling the growth of air cargo demands, Sultan added, “E-commerce is a major component in terms of global air freight volumes.” He mentioned that despite uncertainties about the demand created by e-commerce, it is a significant component in capacity requirement, especially in constrained markets like China and Hong Kong.”

Earlier this year, Atlas Air CEO Michael Steen also warned the industry about a potential capacity shortage amid the e-commerce boom. He mentioned that the demand for main-deck capacity is rising because of e-commerce, but more than 120 ageing widebody freighters will retire soon.

As cargo volumes continue to grow and there’s a massive delay from the OEMs (Original Equipment Manufacturers), airlines, including Emirates, have been considering passenger-to-freighter conversion programmes, which have a significantly shorter wait time than the delivery of new production freighters.

To cope up with the growing demand for freighter aircraft, Emirates SkyCargo is planning to significantly enhance its cargo capacity and fleet efficiency through a two-pronged approach. The airline has ordered five new Boeing 777Fs, with delivery scheduled between 2025 and 2026, and will also convert 10 of its B777-300ER passenger aircraft to freighters under the Israel Aerospace Industries (IAI) “The Big Twin” conversion programme. The conversion programme has been delayed, and the first aircraft in Kalitta Air livery is still waiting for the supplemental type certificate (STC).

The airline’s P2F conversions will take place at Etihad Engineering’s MRO center in Abu Dhabi. Emirates’ Sultan mentioned that these aircraft are currently operational in their passenger fleet. “As in when the STC is received by the IAI, then we will be able to confirm the dates as when these aircraft will be exiting from the passenger fleet and bring over for conversions,” added Sultan.

“Initially, we have ordered ten conversion aircraft,” said Sultan. He mentioned that despite delays, they are constantly in touch with IAI and expect the delivery of the first converted B777-300ER aircraft by the first half of next year.

The converted 777-300ERs will join the airline’s freighter fleet by the end of 2025, taking the total freighter fleet to 17 aircraft. The converted aircraft, along with the new 777Fs, will increase the airline’s main deck cargo capacity by 30% and cater to growing customer demand as well as reinforce its position as a leading player in the global air cargo industry.

The Australian airline Qantas, which operates a combination of converted and production freighters, including A330-200P2F and A321-200P2F, stated to The STAT Trade Times, “The availability of aircraft has been a significant factor in driving the conversion of passenger aircraft to freighters, along with cost. We address technical and operational challenges associated with these conversions through early stakeholder engagement and by allowing buffer time in our schedules to mitigate any unexpected delays.”

“Looking ahead, we’re seeing a trend toward larger narrow aircraft with limited options in the 10 to 20-tonne payload range. There are also increased options for multiple aircraft conversions,” said the spokesperson for the Australian airline. Qantas Freight, a subsidiary of Qantas, an independent Australian air freight services business that ships more than 4,000 air freight items to over 500 destinations globally daily, operates aircraft that are converted from passenger aircraft, with the average lifespan of a freighter aircraft around 35 years, informed the Qantas spokesperson.

Similarly, during a recent interview, Or Zak, COO at Challenge Group highlighted the increasing demand for freighter conversions in the aviation market. The demand is driven by global trade and e-commerce growth, which has led to a significant need for cargo capacity.

The spokesperson added that passenger carriers’ retirement of older aircraft also presents an opportunity for conversions, aligning with the industry’s push towards sustainability. These factors combined contribute to the demand for freighter conversions, allowing operators to efficiently and sustainably meet the growing logistical demands.

Adding to the discussion, Leonard Rodrigues, Director of Revenue Management & Network Planning at Etihad Cargo, highlighted the significant increase in air cargo demand over the past two years, again driven by the surge in Chinese e-commerce and new technologies. He noted that production freighters could not keep up with the rising demand, resulting in a shift from 45% of cargo being transported on freighters and 55% in the belly hold of passenger aircraft in 2019 to 55% on freighters and 45% in the belly hold post-Covid. Rodrigues emphasised that the demand for air cargo is growing faster than the demand for wide body passenger aircraft.

“Converting a passenger aircraft to a freighter costs approximately $25 million, whereas purchasing a new freighter ranges from $150 to $200 million.”

Leonard Rodrigues, Etihad Cargo

Despite using all-new production freighters, Etihad Cargo believes conversions are necessary to ensure supply meets demand. Rodrigues mentioned Abu Dhabi’s role in the 777 Big Twin conversion and highlighted the company’s focus on operating with production freighters while maintaining the option of converting passenger aircraft as needed to prioritise having more passenger aircraft.

This view is not isolated. In fact, airlines like Challenge Group and Etihad, along with OEMs such as Boeing, Airbus and Embraer, share a similar perspective.

In fact, the rising curve for air cago demand is going nowhere. In the wake of COVID-19 pandemic when people stopped travelled and started transporting more parcel, be it the life-saving drugs, vaccines or e-commerce parcels, air cargo sector saw a massive boost. As a result, a lot of new players in the P2F conversions was born. For instance, Mammoth Freighters was established in 2020 while Kansas Modification Center (KMC) was founded in 2021.

What do OEMs think about this growth?The demand for air cargo is expected to increase significantly over the next 20 years. Mammoth Freighters forecasts a need for over 2,600 freighters, including 1,000 large widebody freighters, with the Boeing 777 expected to capture a significant market share due to its superior operating economics and fuel-efficient engines.

Additionally, Boeing’s World Air Cargo Forecast (WACF) 2022-2041 predicts substantial growth in air cargo, driven by the expansion of e-commerce. Global e-commerce revenues are projected to double from pre-pandemic levels, reaching $8.1 trillion by 2026. This will lead to a greater need for air cargo capacity, especially for cross-border e-commerce and emerging markets with limited ground logistics.

According to Boeing, freighter aeroplanes are categorised by capacity:

– Standard body: <45 tonnes, primarily converted from passenger planes.

– Medium widebody: 40-80 tonnes, sourced from conversions and factory production.

– Large freighters: >80 tonnes, with future demand favouring factory production.

Boeing predicts substantial growth in the freighter fleet over the next two decades, with the number of airplanes expected to increase from 2,010 in 2019 to 3,610 by 2041, representing a 3% average annual growth. The company forecasts approximately 2,800 deliveries, with half replacing retiring aeroplanes. The majority of these deliveries will involve conversions, particularly of standard-body aircraft, and are driven by the increasing demand for e-commerce and express cargo operations.

The Asia-Pacific region is expected to significantly drive this growth, requiring over 1,000 new freighters by 2040. In particular, Boeing anticipates a 90% growth in the standard body segment, with 1,300 conversions expected, and a 75% growth in the widebody segment, with 515 new widebody freighters projected to meet the expanding express networks and the need for replacements. These new widebodies are seen as crucial for long-haul, general air cargo services due to their cost efficiency and range.

OEMs and component manufacturers believe the demand for cargo planes will increase massively in the coming years. For instance, Rolls-Royce, which powers the heart of many of these metal birds, anticipates significant growth in its freighter business, historically a smaller engine maker segment driven by increased e-commerce and shifting airline routes.

The British automotive and engine-making company sees opportunities, particularly with Airbus’s A350F freighter programme, powered by Rolls-Royce Trent XWB engines, and the A330P2F conversions. Demand for large cargo aircraft is expected to grow, with Rolls-Royce projecting the need for 500 aircraft over the next two decades.

The A330P2F programme, which began over a decade ago, is poised for increased demand. Expectations are to convert at least 250 A330ceos to freighters, peaking around 2028-2029. Most of these conversions use Rolls-Royce Trent 700 engines, which will provide long-term service revenue. The A330 is seen as a natural successor to the Boeing 767, whose suitable feedstock is dwindling.

Honeywell notes that air cargo demand has increased pre- and post-COVID-19. However, airlines converting their passenger fleet to cargo must consider compliance, safety, fuel efficiency, route optimization, and weight reduction. Honeywell offers plug-and-play upgrades for extended fleet life.

Key players and programmes in the P2F conversion spaceSeveral companies are at the forefront of passenger-to-freighter conversions. For example, IAI has initiated a conversion programme for the Boeing 777-300ER called “The Big Twin,” which has already secured orders for 20 aircraft and 10 options.

In 2019, the first-ever P2F Boeing 777-300ER conversion programme, a collaboration between AerCap Cargo and IAI, known as ”The Big Twin,” was launched. The first converted Boeing 777-300ER was revealed in Kalitta Air livery and is ready to enter the market. This conversion programme, launched in 2019 by GE Capital Aviation Services (now AerCap) in partnership with IAI, faced delays due to the COVID-19 pandemic but is expected to receive FAA certification by the end of 2024.

The first aircraft (prototype), which was converted under the ‘The Big Twin’ programme, was originally operated by Emirates. The programme claims that the converted freighter has 25% more cargo capacity than the original B777F and 21% lower fuel consumption than the B747F.

The conversion process was completed in early 2023, with the prototype making its first public appearance at the Dubai Airshow in November 2023. AerCap has firm orders for 20 B777-300ERSF (Extended Range Special Freighter, also called Big Twin) aircraft and ten options, with buyers including Emirates SkyCargo, Challenge Group, and EVA Air Cargo. IAI is expanding its conversion facilities globally, with new sites in South Korea, Abu Dhabi, and Arizona to meet the growing demand for widebody freighters driven by the booming e-commerce industry. Recent reports suggest IAI is considering launching a conversion programme for the Boeing 787 as it weighs up future projects.

Regarding conversion programmes, Challenge Group’s Zak added, “A notable example is our partnership with IAI, through which we converted 767 passenger planes into freighters. This collaboration even established a dedicated conversion line for us in Belgrade.”

However, Challenge Group is considering to withdrawing from a deal to acquire three Boeing 777-300ER passenger planes formerly owned by Jet Airways, which have been parked in Mumbai since the airline’s collapse in 2019. The deal, worth $47 million, has been delayed for two years despite court orders to hand over the planes to the Challenge Group.

Challenge Group made this acquisition bid through its Malta-based airline – Challenge Airlines MT – which received its Maltese Air Operator Certificate (AOC) in 2022 and currently operates a fleet of three B767-300F aircraft.

The Malta-based airline has paid a $5.6 million deposit, which it now wants back with interest if the deal falls through. The aircraft are in a worse technical condition than when the bidding started, and making them airworthy again would be time-consuming and costly. Ace Aviation, a subsidiary of the Malta-based Challenge Group, has filed an appeal in the National Company Law Tribunal (NCLT), which has directed the monitoring committee to file a response to the plea on May 17, 2024.

On the other hand, the Mammoth 777-200LRMF is the company’s main freighter product. Once certified, it will offer the high payload and utility needed for general cargo operators worldwide. Mammoth claims that it is affordable, flexible, and purpose-built. Additionally, Mammoth states that its 777-300 ERMF can carry 14% more volume than a 747-400F, 81% more volume than a 767-300BCF, and 43% more volume than an MD-11F.

KMC has designed the 777-300ERCF freighter with an innovative forward-door design, minimising empty weight and maximising payload. The FAA has accepted the certification plan, reducing the risk of design changes and delays. By placing the main cargo door forward of the wing, KMC’s design reduces empty weight, leading to higher payload revenue on longer routes and fewer modifications required. The forward door also provides easier cargo handling, with improved access and more cargo ramp area, and features a robust floor designed for cargo durability. The design also includes a rigid cargo barrier and a supernumerary cabin with crew rest and galley facilities.

However, none of the B777 P2F conversion programmes have received STC approval from the Federal Aviation Administration (FAA) yet.

Airbus also heavily invests in its freighter conversion programme, focusing on the A330-300P2F and A320P2F. According to Airbus, the A330-300P2F is well-suited for integrators and express carriers due to its high volumetric payload capability for lower-density cargo.

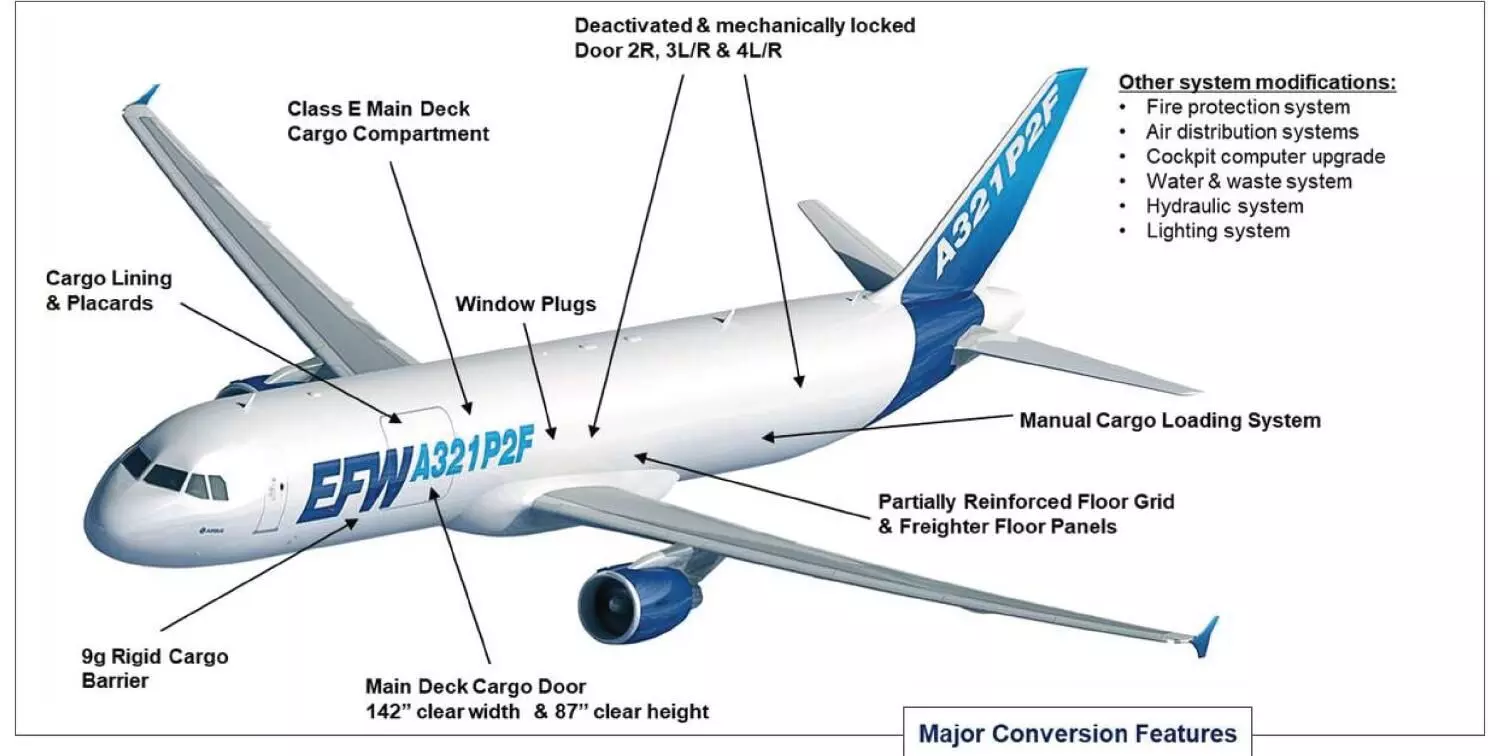

Another important company in the aircraft conversion industry is EFW, which specialises in converting Airbus widebody freighters, particularly the A330P2F. They also convert the A321 and A320 passenger aircraft to freighters, claiming lower fuel burn and efficient operations. These conversions offer main deck cargo access and various courier area layouts.

Source: EFW

Another recent development in the sector is that US Cargo Systems and Embraer have completed the FAA installation conformity for the E190F, a crucial step in the E-Freighter programme. This confirms that the new components on the aircraft meet certification requirements and are correctly installed for safe cargo operation. Embraer is converting its E-Jet passenger planes into cargo freighters, including the E190 and E195. The E190F recently completed its maiden flight in São José dos Campos, Brazil. Additionally, Embraer has signed a memorandum of understanding with Correios, Brazil’s postal company, to focus on air cargo transport.

Azul Linhas Aéreas Brasileiras, which served as the ‘guinea pig’ for the Embraer 195E1 P2F conversion and helped with the initial testing of the conversion programme, plans to convert three more. On the other hand, Nordic Aviation Capital (NAC), the launch lessor for Embraer’s E-Jet P2F conversions, announced in May 2022 that they will convert up to 10 Embraer E190/E195 aircraft. According to Embraer, converted E-Jets will offer over 50% more volume capacity, three times the range of large cargo turboprops, and up to 30% lower operating costs compared to narrowbodies. The maximum structural payload for the E190F is 13,500 kg, and for the E195F, it is 14,300 kg.

Why should an airline consider P2F-converted aircraft?

Source: Kuehne + Nagel

Though requiring significant investment and expertise, the process offers a cost-effective way to increase air cargo capacity.

According to the Challenge Group’s Zak, converting freighters provides several advantages over newly manufactured freighters, particularly in terms of cost efficiency. Converting existing passenger aircraft into freighters is generally more affordable than purchasing brand-new freighter aircraft, allowing operators to expand their cargo capacity faster with less capital outlay.

Rodrigues pointed out, “Converting a passenger aircraft to a freighter costs approximately $25 million, whereas purchasing a new freighter ranges from $150 to $200 million, making conversion a significantly cheaper alternative.”

“Converted freighters also provide a faster return on investment (ROI).”

Or Zak, Challenge Group

Zak added that converted freighters also provide a faster return on investment (ROI). The freighter conversion process is quicker and less expensive than building new aircraft, allowing operators to start generating revenue sooner. Converting older but serviceable aircraft also contributes to sustainability by giving them a second life and reducing waste. This makes converted freighters a highly attractive option for expanding cargo operations.

The Future of ConversionsPassenger-to-freighter conversions are crucial for the air cargo industry to meet the increasing demand. As the industry evolves, these conditions will be more critical in serving e-commerce and express cargo operators. With proper investment and expertise, these conversions can offer a cost-effective and efficient way to expand air cargo capacity, addressing the needs of a rapidly growing market. As the demand for air cargo capacity continues to rise, it’s evident that passenger-to-freighter conversions are here to stay. With the industry’s benefits of cost savings, flexibility, and sustainability, converted freighters are an appealing solution for airlines and cargo operators aiming to remain competitive.