If companies have learned one lesson from the pandemic era, it’s that developing agile, proactive operations is key to seamlessly adapt to disruption that turns the market upside down. The shift from a tight market to today’s stable, soft market has given shippers time to reset and refine their logistics programs to drive cost savings and quality service.

However, while shippers have enjoyed low spot rates and abundant capacity for the past two years, it’s never too early to prepare for a market turn. First tender acceptance (FTA)—the frequency with which first-awarded carriers accept shipment tenders—should be a KPI of focus. In a market turn, unprepared shippers could face an abrupt decrease in FTA rates, resulting in higher procurement expenses and a degradation in service.

To help logistics teams better prepare for a potentially tighter market this year, our research team at Uber Freight reviewed industry data and our historical network data to conduct predictive and prescriptive research about how the state of the market impacts FTA. Our findings provide insight into how a market shift could impact shippers’ networks, and actionable steps for teams to improve their FTA rates and maintain high-quality service.

Will the market actually turn in 2024?

Economic forecasts initially communicated that the freight market would turn in the last half of 2023. However, as of May 2024, we’re still seeing spot rates bottoming out and routing guide compliance at an all-time high.

In hindsight, it’s clear that those forecasts underestimated the impact of high profits that trucking firms accumulated during the pandemic. Carrier revenue momentum from the tight market carried over to the past two years, with profits hitting record highs: long-distance trucking firms earned their highest revenue ever in 2022 at $252 million. Our research tells us a market turn in 2024 is very possible, with the telltale sign being a recent, significant drop in carrier revenue and contract rates. In Q3 of 2023, contract rates dropped 18% year over year. Historically, when contract rates fall, carriers reduce their headcount—and shippers could face skyrocketing spot rates and lower FTAs.

These factors impact FTAs

To maintain a high level of service, shippers must make proactive changes to routing guides and carrier partnerships. We used half a million loads that took place on the Uber Freight network to develop quantitative FTA forecasts under different scenarios, considering a few key variables that are readily available to shippers.

First and foremost, a tight market will cause FTA rates to plummet. When spot rates are high, carriers are more likely to reject tendered loads because they have leverage to weigh the most financially beneficial opportunities when there’s limited capacity. When the market was tight in January 2022, FTA rates averaged 60-70%. The rates gradually increased to more than 90% as the market softened over the next two years. Rate-to-market, the tendered rate divided by the spot rate on a given lane during the same month, is a key predictor that influences FTA rates: tender acceptance usually increases when the rate-to-market is higher. The rate duration and tender frequency on a given lane also impact FTA, as carriers are more likely to accept tenders from contracts that have been in place for longer and include a higher number of loads.

Scenario planning helps forecast FTA rate changes

The smartest way to prepare for a market turn is to consider how certain realistic scenarios will impact FTA rates. Our team used predictive modeling to forecast three potential outcomes: 1. A scenario where spot rates remain the same for the next 12 months

A baseline, probable scenario where spot rates rise by 4% year-over-year over the course of 2024, with larger increases in Q3 and Q4.

An inflationary (albeit unlikely) scenario where spot rates rise by 12% year-over-year

In the flat scenario, the FTA rate consistently remains at 90%. In the base scenario, the FTA drops to 87%. Finally, in the inflationary scenario, the FTA rate plummets to 79%.

Companies that aren’t ready for the baseline and inflationary scenarios could experience a deterioration in service and higher expenses, especially if they have to resort to the spot market to transport their freight. In these scenarios, medium and long hauls will likely be more impacted than short hauls, as their tender acceptance rates will fall at a more drastic pace.

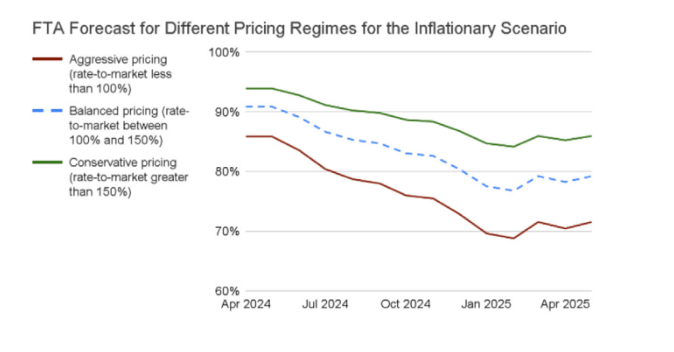

In an inflationary scenario, service levels could fall drastically across all lanes with aggressively priced lanes (those whose rate to market is less than 100% as shown above) being impacted the most (with a 16% decrease in FTA).

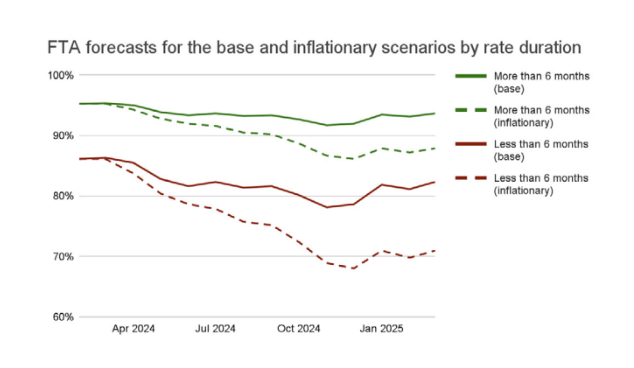

Rates that have been in place for more than six months will experience less of an FTA drop than rate durations of less than six months.

Strategies to keep FTA high—no matter the market conditions

While the market is soft, it’s vital for shippers to analyze their supply chain vulnerabilities and pinpoint the most beneficial changes to their transportation budgets, routing guide structure, and carrier relationships:

Price lanes accordingly. Compare your contracted rates to spot rates, and use that information to offer more attractive pricing for lanes at risk of tender rejection. Focus on long hauls, as there will be fewer carriers willing to spend days moving a load at the expense of more profitable opportunities.

Budget for involuntary spot volume. If tender rejections increase and routing guide compliance decreases, spot rates will increase—and so will the likelihood of shippers having to resort to the spot market to move their goods.

Build productive carrier relationships at the lane level. Carriers are more likely to accept a tender if the rate has been in place for more than six months. Consistently vet carriers and communicate service feedback when necessary.

Whether the market turns or remains the same in the coming months, start preparing for any scenario today with actionable insights from our tender acceptance whitepaper.