Over the past few months, the Red Sea has shifted from a highly trafficked maritime passage to something more like a battleground. Attacks on cargo vessels by Houthi rebels have threatened both regional stability and the arteries of global commerce.

On March 2, the Rubymar finally sank. The cargo ship had been targeted by Houthi militants on Feb. 18 and had been taking on water in the days since. It’s the first vessel lost to the Houthi attacks in and around the Red Sea, which began in November 2023. This incident, which has led to a multimile oil slick and the submerging of 21,000 metric tons of fertilizer, not only highlights the immediate environmental hazards but also casts a long shadow over the security of a key conduit for international trade.

But is it possible that the worst of the damage has already been done, at least when it comes to trade?

Houthi attacks have undoubtedly added a new layer of complexity and risk, not to mention heightened danger for crews, but their effect on commerce may be starting to wane.

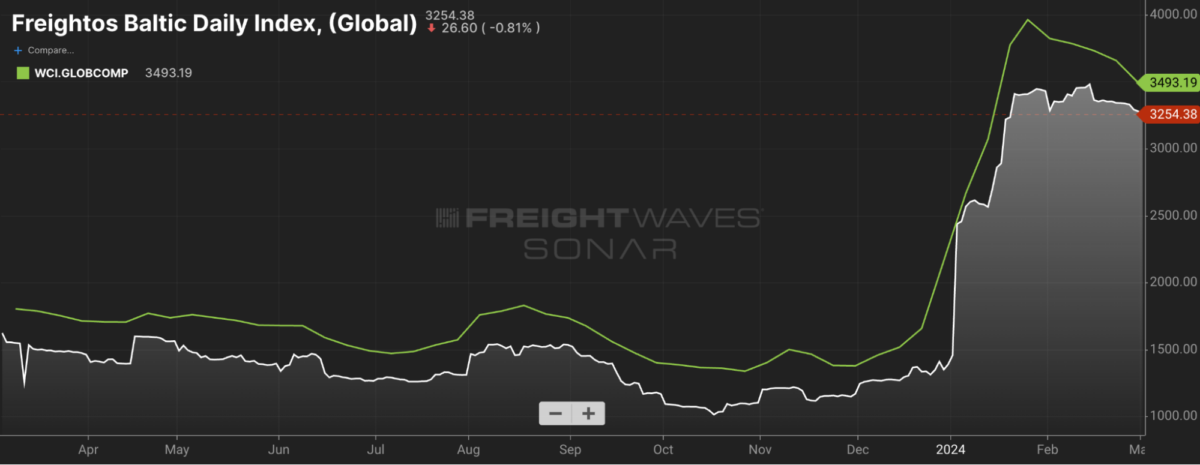

To be sure, the longer container spot rates stay elevated above late-2023 figures, the more cost shippers and consumers will bear, while container lines remain the beneficiaries. Drewry’s World Container Index Global Composite price is still more than 150% higher than it was at the end of October 2023. But it’s also dropped by more than 10% since late January.

However, well-connected supply chains have the ability to change course like rivers. And the tactics employed by the Houthi rebels — namely, the use of missiles and drones to target vessels it sees as aligned with Israel — may be more like a large rock thrown from the bank than a full-stop dam.

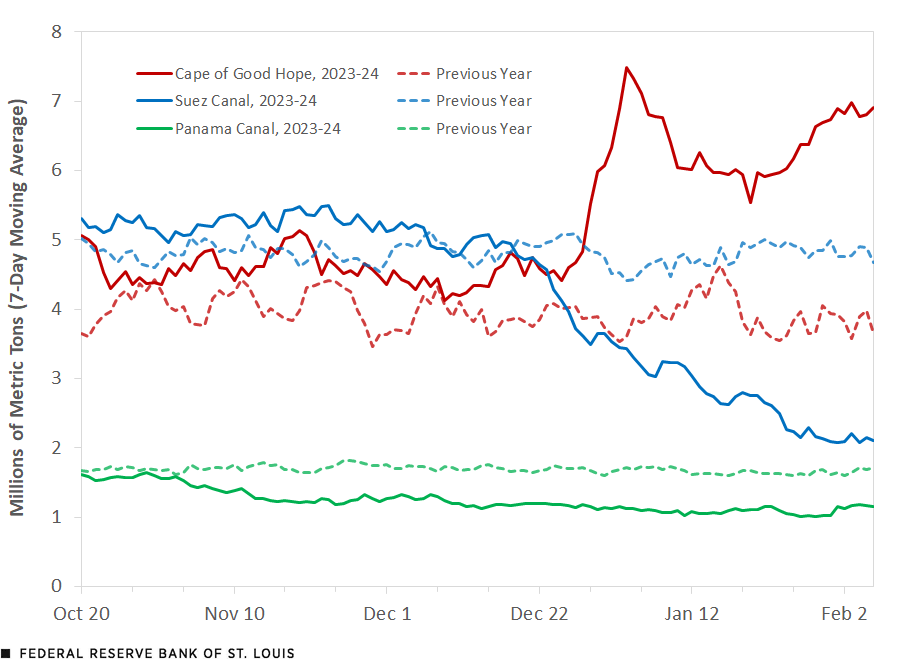

The decision by many shipping operators to reroute their vessels more safely around the southern tip of Africa does introduce significant delays and additional costs. It has affected timelines for the delivery of goods and exacerbated logistical challenges in a global economy grappling with the aftermath of the pandemic and other ongoing geopolitical conflicts.

But now, ocean freight is clearing post-Chinese Lunar New Year backlogs, and then it will enter its slow season, just in time to alleviate the capacity that’s been soaked up from longer transit times.“And while rates should still remain above normal levels as long as diversions continue and carriers pass on higher costs, the European Shipping Council estimates that ocean rates and surcharges for Red Sea diversions are far outstripping these increased costs faced by carriers,” wrote Judah Levine, head of research at the Freightos Group, in an outlook blog last week. “This assessment, together with pessimistic outlooks for European ocean volumes this year, also points to the likelihood of ocean prices coming down from current levels.”

This analysis puts U.S. retaliatory measures into some context. As of last week, the U.S. had conducted airstrikes against 230 Houthi targets in Yemen, Deputy Assistant Secretary of Defense Daniel Shapiro said in a Senate Foreign Relations Committee hearing.

It does matter that despite the destruction of numerous Houthi weapons, the attacks continue. The efficacy of U.S. countermeasures, against a backdrop of continued hostilities and the potential for escalation, remains a subject of scrutiny and debate.

Neither should the environmental repercussions of incidents like the sinking of the Rubymar be overlooked. Continued attacks could cause ecological damage to the Red Sea’s unique marine ecosystems and the industries that rely on them, like fishing.

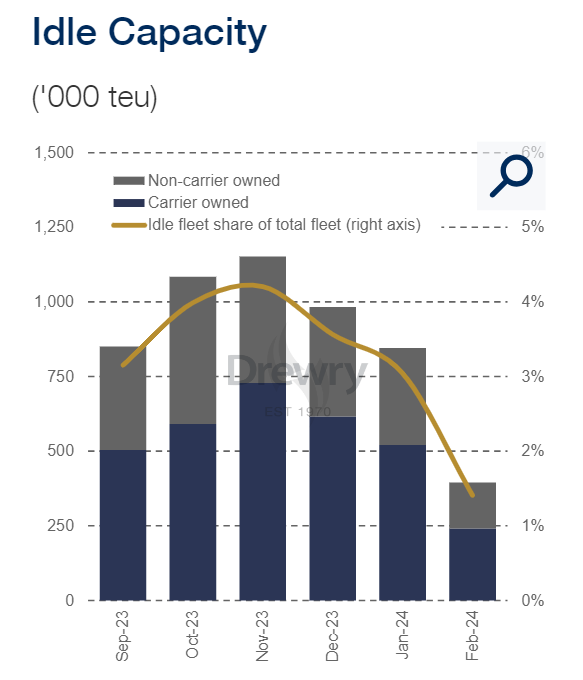

But for the time being, global supply chains appear to be reallocating resources effectively, as evidenced by spot rates continuing to fall despite idle capacity tightening. Unless the Red Sea holdups lead to a massively costly capacity crunch in the coming months, it is unlikely the U.S. will feel pressured to up the ante.

On Monday, a series of explosions claimed by the Houthis resulted in a fire onboard the Liberia-flagged MSC SKY in the Arabian Sea. No casualties were reported, but it stands as the most serious assault so far in March. Here’s what the past few months have seen:

February 2024

The first attacks of the month were on Feb. 6 with the targeting of the Star Nasia and Morning Tide, leading to minor damage to the former. The aggression continued with attacks on the Star Iris and Pollux, both resulting in minor damage but no casualties. The most severe incident was on Feb. 18 when the Rubymar suffered catastrophic damage in the Bab el-Mandeb strait, necessitating a crew evacuation.

This period also saw attacks on the Sea Champion, Navis Fortuna and MSC Silver II, among others.

January 2024

The first attack of the year was on Jan. 10, when a barrage of unmanned aerial vehicles and missiles targeted naval forces. There was no reported damage due to effective countermeasures. The St. Nikolas oil tanker’s capture the following day marked a further escalation by Houthi forces.

RELATED: Is the Red Sea effect on container shipping being overblown?

Throughout the month, various commercial and military vessels, including the USS Laboon, Gibraltar Eagle, Zografia and others, faced missile and UAV attacks.

December 2023

December saw missile strikes on the Unity Explorer, Number 9 and Sophie II on Dec. 3. All sustained minor damage. A combined missile and UAV attack on Dec. 11 targeted the Strinda and the French Navy’s Languedoc, causing onboard fires and other damage.

The month also witnessed hijacking attempts and further missile and UAV strikes against vessels like the Ardmore Encounter, Maersk Gibraltar and Al Jasrah, demonstrating the Houthis’ sustained capability and intent to disrupt maritime traffic.

November 2023

The Houthis began their operations in November with the capture of the Galaxy Leader, transforming it into a tourist attraction in Hodeidah, Yemen. The crew’s whereabouts are still unknown.

The CMA CGM Symi and Central Park also encountered UAV and missile threats, narrowly avoiding severe damage. These initial incidents signaled a shift toward direct action against maritime assets, posing a new level of threat to international shipping and regional security.