In April, residential housing construction for single-family homes was mostly flat sequentially but still 22% higher than last year. For flatbed carriers looking for demand signals of an improving truckload market, the April result shows the market is in a holding pattern now the Federal Reserve has indicated rate cuts may not occur this year as expected. According to the U.S. Census Bureau, starts were at an annual rate of 1.36 million, 5.7% higher than the downwardly revised March number of 1.29 million.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Another crucial indicator, permit data, showed a slight decline in April, coming in at 1.44 million, down from the upwardly revised 1.485 million in March. Both figures were slightly below the comparable month in 2023. This trend in permit data provides valuable insights into future building activity, which can have significant implications for the truckload market.

“However, homebuilders are starting to feel less confident as mortgage rates hover around 7% and consumer confidence starts to weaken. This year, permits for constructing new single-family homes reflecting future building activity are also higher. Still, the year-over-year increase in permit activity has slowed,” said Bright MLS Chief Economist Lisa Sturtevant.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

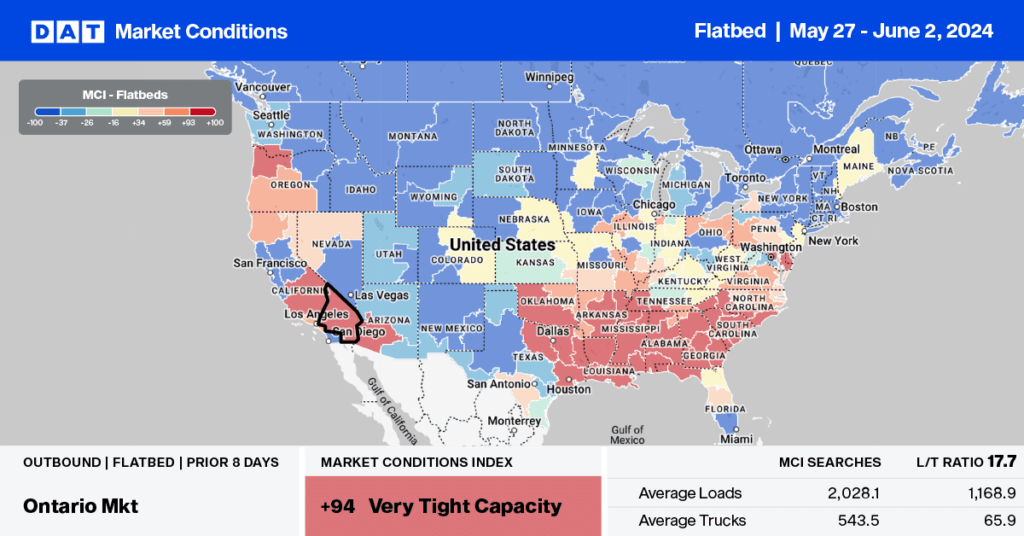

Flatbed capacity tightened in Texas during a short shipping week, with volumes 35% lower last week. Outbound linehaul rates increased by $0.03/mile to $2.17/mile. Most of the gains came from the Dallas market, where at $2.02/mile for outbound loads, linehaul rates were $0.04/mile higher last week. On the Dallas to Houston regional lane, rates were the highest in 12 months, averaging $518/load last week, compensating for the decline in rates in the opposite direction.

In contrast, Houston to Dallas carriers were paid an average of $650/mile last week, over $100/load lower than last year, but still a respectable round-trip average of $2.41/mile, $0.74/mile higher than the national average, and $0.24/mile higher than the state average.

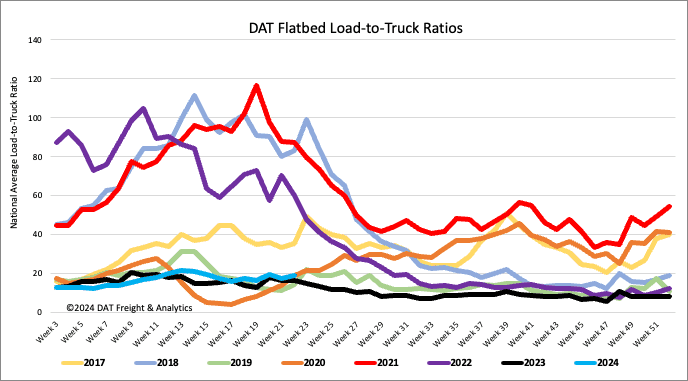

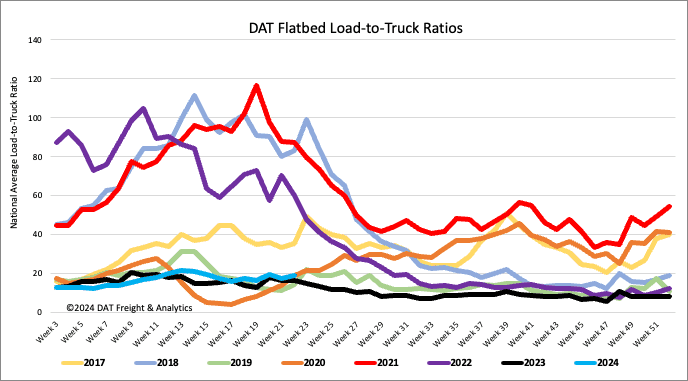

Load-to-Truck Ratio

Flatbed load post volumes decreased on a short week at almost the identical rate to last year, following Memorial Day, down 13% w/w. Flatbed load post volumes are 10% lower than last year, while equipment posts are 23% lower. Last week’s flatbed load-to-truck ratio was 9% higher at 19.29.

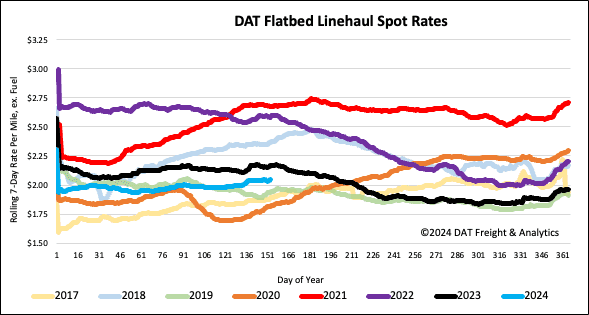

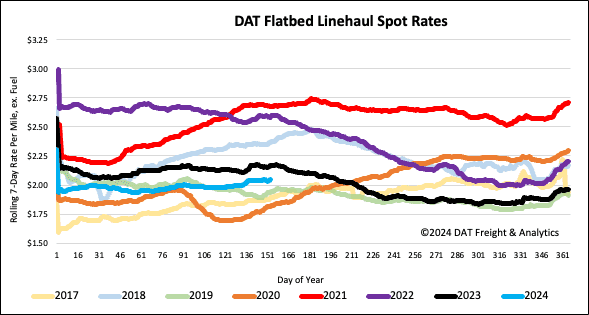

Spot rates

Flatbed linehaul rates have remained mostly flat for the last three weeks, averaging around $2.07/mile. The national average is $0.12/mile lower than last year on a 10% higher volume of loads moved in Week 22 last year.