The Home Depot, the world’s largest home improvement retailer, reported sales of $43.2 billion for the second quarter of fiscal 2024. Comparable sales for the second quarter of fiscal 2024 decreased 3.3%, and comparable sales in the U.S. decreased 3.6%. According to Ted Decker, chair, president, and CEO, “the company’s sales at stores that open at least 12 months will fall between 3% and 4% this year compared to last year. Higher interest rates and greater macro-economic uncertainty pressured consumer demand more broadly during the quarter, resulting in weaker spending across home improvement projects.”

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

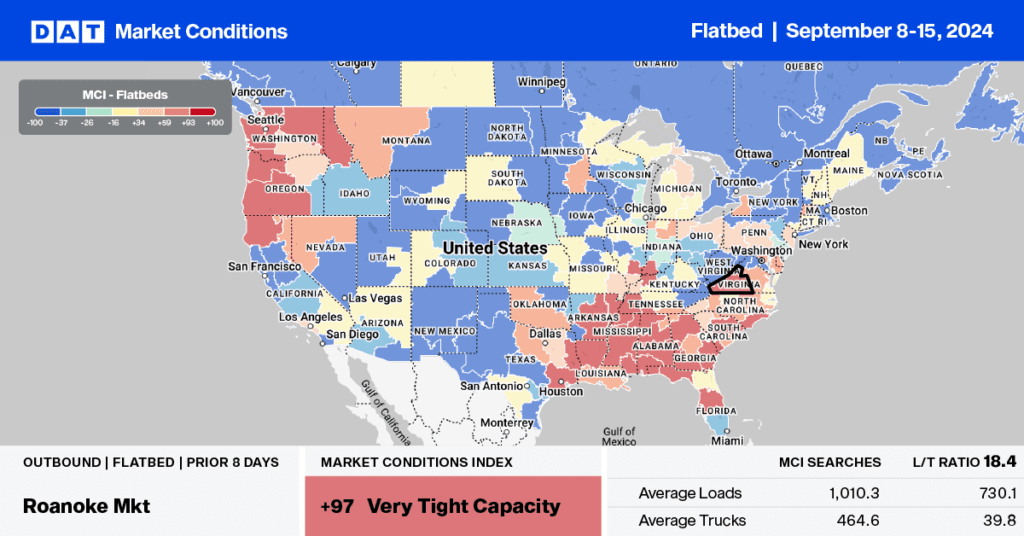

This week, let’s focus on Gulf Coast markets in the Southeast Region, severely impacted by Hurricane Francine, which made landfall in Terrebonne Parish, Louisiana, as a Category 2 storm on Monday, September 9. The hurricane caused widespread power outages, flooding, and damage across the region. After landfall, over 400,000 homes and businesses were without power in Louisiana and Mississippi, with winds up to 80 mph causing damage. The storm put more than 10 million people under flood alerts, especially in Alabama, Arkansas, Tennessee, southwest Georgia, and the Florida Panhandle.

According to DAT’s Market Condition Index (MCI), flatbed truckload capacity was very tight last week in the Southeast Region and is forecast to remain the same well into this week as recovery and rebuilding efforts are underway. On the high-volume regional flatbed lane between the Dallas/Ft Worth metroplex and New Orleans, volumes jumped by 17% w/w, along with inbound linehaul rates up $0.29/mile to $1.89/mile. Short-term volatility on the Houston to New Orleans lane was also observed late last week; 3-day spot rates were up $0.58/mile last Friday to an average of $2.94/mile, almost $0.70/mile higher than the 12-month average.

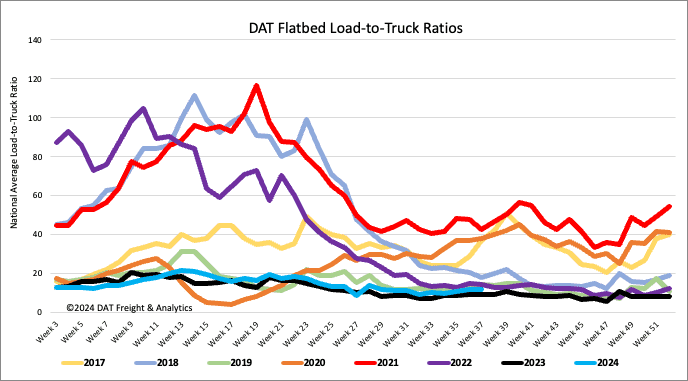

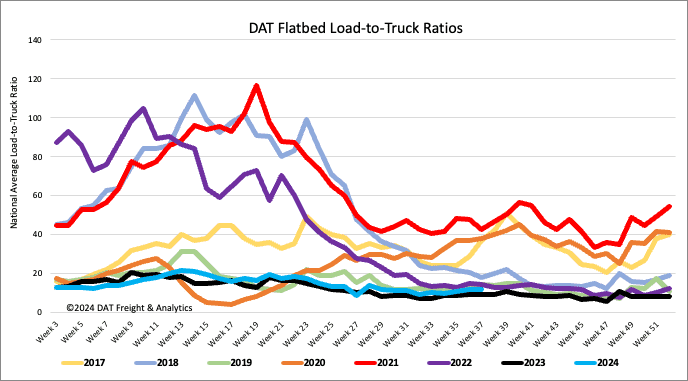

Load-to-Truck Ratio

The volume of flatbed load posts jumped last week following the Labor Day short workweek, increasing by 18% w/w and 2% y/y. Carriers returned to the market, increasing equipment posts by 16% w/w, resulting in last week’s flatbed load-to-truck ratio increasing slightly to 11.80.

Spot rates

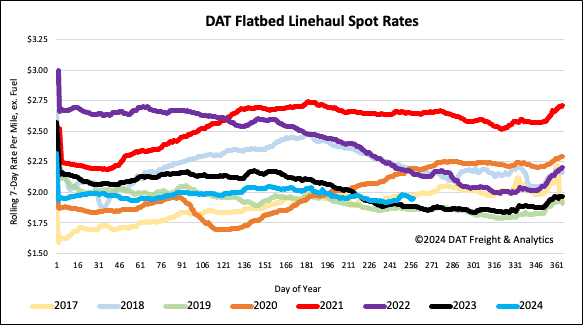

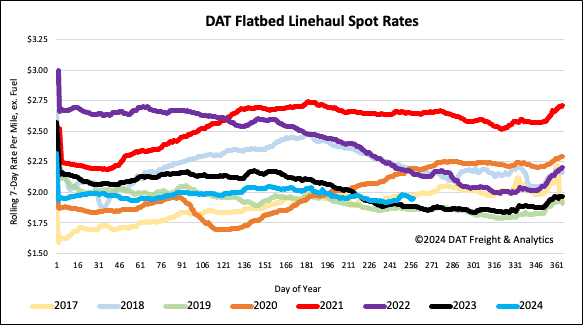

Flatbed linehaul rates erased all of the prior week’s gains following last week’s $0.04/mile increase to a national average of $1.97/mile. Flatbed linehaul rates are $0.02/mile higher than last year, $0.11/mile higher than 2019, and $0.04/mile lower than the three-month trailing average.