Weekly highlights

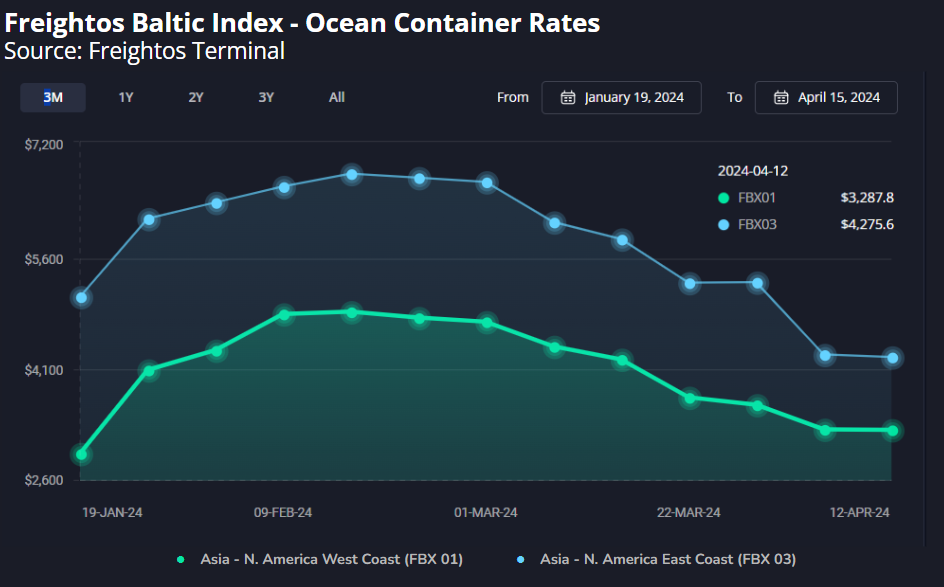

Asia-US West Coast prices (FBX01 Weekly) were level at $3,288/FEU.

Asia-US East Coast prices(FBX03 Weekly) fell 1% to $4,276/FEU.

Asia-N. Europe prices(FBX11 Weekly) increased 7% to $3,545/FEU.

Asia-Mediterranean prices(FBX13 Weekly) increased 3% to $4,436/FEU.

China – N. America weekly prices increased 69% to $6.17/kg

China – N. Europe weekly prices fell 2% to $3.30/kg.

N. Europe – N. America weekly increased 1% to $1.88/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

The day before Iran’s saturday missile and drone attack on Israel this weekend, the IRGC seized an Israeli-owned, MSC-operated container vessel near the Strait of Hormuz sailing from the Persian Gulf on its way to India. Alongside the ongoing, Iran-sponsored, attacks on Red Sea traffic, this event poses yet another potential challenge to the container industry.

If attacks like this one continue, broaden, or Iran moves to completely close the strait, Middle East container flows would feel the strongest impact. A closure would see Kuwait, Iraq and most of the UAE’s ports become inaccessible. Saudi Arabia, with access to their Red Sea port access already challenged, would see their Gulf port access cut off as well. These disruptions would also impact container hubs in India some of which are part of services that connect S. Asia and the Middle East.

On N. America’s East Coast, alternative ports continue to handle the rerouting away from the Port of Baltimore without reports of significant congestion or with increases in freight rates. Now, several weeks post the bridge collapse, it is unlikely that congestion or disruptions will materialize.

Ex-Asia ocean rates to N. America were level last week, and prices to Europe and the Mediterranean ticked up slightly, suggesting that container rates have reached their slow season, Red Sea diversion-adjusted floor of $3,000 – $4,500/FEU.

If diversions continue into the Q3 peak season months, we can expect rates to increase relative to this floor. And though volumes are likely to rebound to Europe, expectations, overall, are subdued. Demand projections for N. American imports are more optimistic. The latest National Retail Federation ocean import report for N. America projects volumes to be strong relative both to last year and to 2019 as we move into Q2 with total H1 volumes about 11% higher than in both 2019 and 2023, and with peak months of July and August about 5% above 2019 levels as well.

For most of the second half of last year, after coming down from pandemic-driven highs, transatlantic ocean rates leveled off at a loss-making $1,200/FEU. Early this year though, Red Sea diversions had knock-on effects on this lane too, with rates climbing to nearly $1,900/FEU in February. Rates have eased somewhat since then, but the latest volume reports suggest that a 10% year on year Q1 rebound in transatlantic demand also contributed to those stronger rates. At $1,728/FEU last week, and alongside reports of stronger utilization levels, prices on this lane may no longer be facing downward pressure.

In air cargo, B2C e-commerce demand out of China continues to be the biggest driver of strong volumes, tighter capacity and upward pressure on rates to N. America even during these typically slow months for air cargo. With Freightos Air Index prices from China to N. America at more than $6/kg last week – compared to the pre-pandemic norm closer to $2/kg for non-peak months – stakeholders are worried about spiking rates and trouble securing space during the Q4 peak season months when demand for both e-commerce and more traditional air cargo goods will increase.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.