Amazon Air expanded its air cargo capacity last year through the addition of larger aircraft but also simplified its network and conducted fewer flights.

The latest study from The Chaddick Institute for Metropolitan Development shows that in the five weeks running to March 12, Amazon Air increased its US tonnage capacity by 4.9% compared with the same period last year, while total daily flights fell by 1.8% compared with the same period last year.

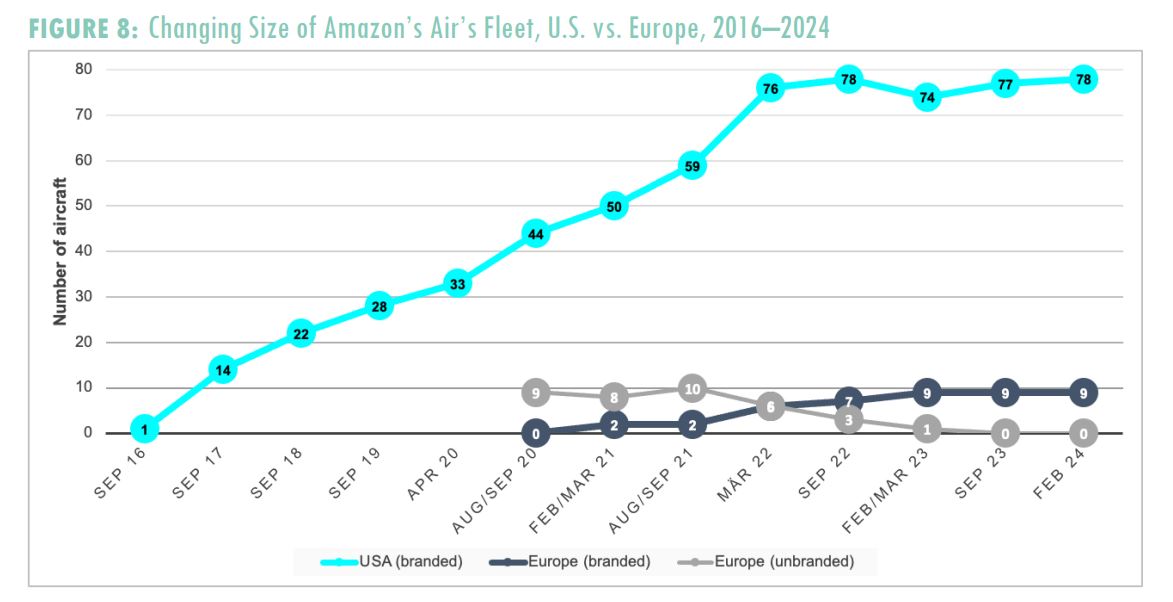

This comes as the airline moved to larger aircraft and consolidated operations at fewer hubs. Since March last year, the carrier has added three Boeing 767-300s, all operated by Air Transportation International, and its first Airbus A330-300, operated by Hawaiian.

In the process, the percentage of the fleet comprised of 737 or smaller planes has fallen from 38% to 33% over the past year.

The carrier also stopped using ATR-72 turboprops over the last year and reduced the number of airports it flew to.

Overall, Amazon Air’s US fleet increased by one aircraft to 78.

“The push to simplify the US airport network ended regular flights to Des Moines International (DSM), Mobile International (BFM), Omaha Eppley (OMA), San Jose (Mineta) International, (SCJ), Tampa International (TPA) and Wichita/Eisenhower National (ICT), several of which had only seen the turboprops,” the report stated.

“Amazon Air halved service to Las Vegas, NV, which is less than a four-hour truck trip from its San Bernardino hub, and cut service by roughly a third at Baltimore-Washington Marshall Intl. (BWI), which is approximately 7.5 hours from the Wilmington, OH, hub.

“No new US airports gained regular service, giving Amazon Air a consistent presence in 47 US airports, down from 53 last year.”

Looking ahead, Amazon has plans to expand its A330 fleet to 10 aircraft, which would place more emphasis on larger aircraft.

If this occurs, Amazon Air’s tonnage capacity will grow by 17% compared with a year ago.

The report said that the move to a hub and spoke operation and away from point-to-point flying brings its strategy closer to that of express giants UPS and FedEx.

“Amazon Air’s network has gradually grown to be more like that of FedEx and UPS,” the report states. “These air cargo integrators have long been hub-centric, with nearly identical schedules day after day (except for weekends and holidays).

“Their networks have been gradually fine-tuned to maximise their versatility for guaranteed delivery the next morning or afternoon. Amazon is pursuing a similar strategy in North America. More than four in five Amazon Air flights (80.5%) within the US mainland operate to or from its five largest hubs, up from 65.6% in early 2021.”

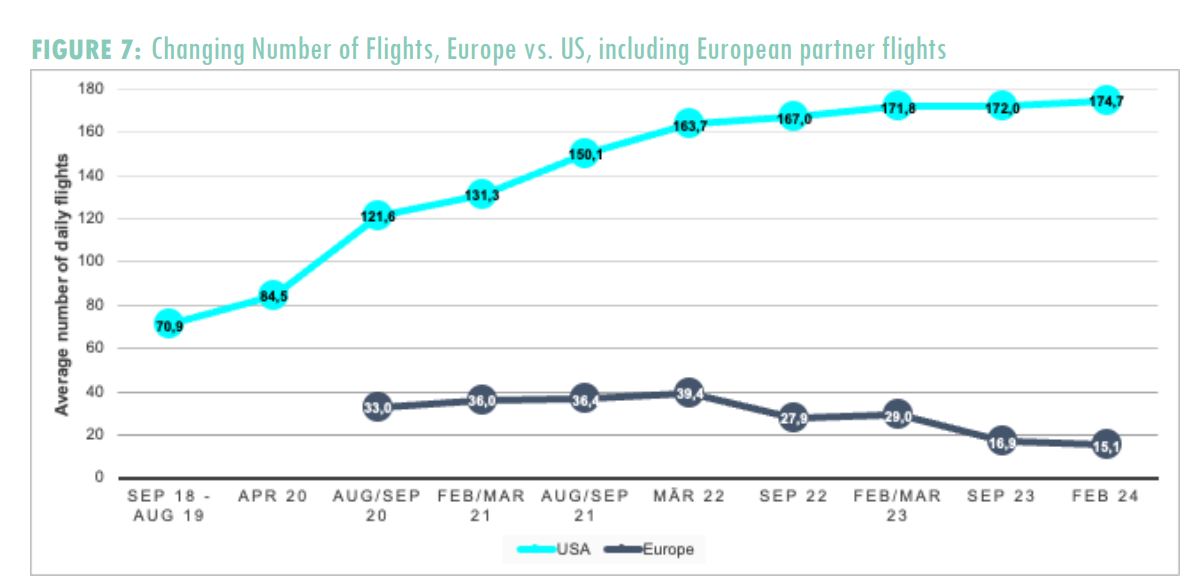

But while the carrier has been growing capacity in the US, in Europe it has been rapidly decreasing its flight activity.

The report shows that the number of flights in Europe has fallen by 37.5% since last year as the airline has reduced its activity at Leipzig/Halle, Cologne/Bonn and East Midlands.

Source: The Chaddick Institute for Metropolitan Development

Looking ahead, Amazon is expected to continue expanding its US hub and spoke, and international operations.

“Amazon Air’s restraint over the past two years and the redesign of its network have laid the groundwork for focused expansion aimed at further expanding its next-day package deliverycapabilities.

“We believe the retailer will primarily emphasize CVG and growth in Fort Worth, Lakeland, and San Bernardino.

“Amazon’s entry into India foreshadows new routes in developing countries, with South America, the Pacific Rim, and Middle East flying being solid possibilities. However, we expect Amazon to start small in these regions.”

The report also predicts some growth in the European network, although at a considered pace.

“Amazon will remain relatively small in Europe, but it will at least partially bounce back while continuing to adjust its flight schedule more frequently than the air cargo integrators. We expect most of the growth to be where its logistics infrastructure, including fulfilment or sorting centres, is expanding.

“Scandinavia and Southeast Europe, including Greece and the Balkan countries, are particularly positioned for more service. However, the ability to transport cargo by truck or in aircraft from other providers will prevent US-style hub development.”

The report was authored by Joseph Schwieterman, Toni Jahn and Steve Rudolph.

Amazon not yet scaling back flights in face of economic challenges