J.B. Hunt Transport Services said peak season for its intermodal and highway services segments was strong and that it’s seeing some customers secure capacity earlier than normal, which is usually a harbinger of an improving environment.

The Lowell, Arkansas-based multimodal transportation provider reported earnings per share of $1.53 Thursday after the market closed. The result included a roughly 13-cent headwind, or $16 million, from intangible asset impairments. The consensus estimate for the period was $1.62 per share and in line with the company’s result excluding the charges.

Consolidated revenue fell 5% year over year to $3.15 billion. Adjusted operating income of $223 million (excluding the impairments) was 13% lower y/y.

The company guided to a 20% to 25% sequential decline in consolidated operating income (after consideration of the one-off charges) from the fourth to the first quarter, assuming normal seasonal trends. That is in line with its prior 10-year experience excluding two of the pandemic years.

The fourth-quarter result and guide sent shares of J.B. Hunt (NASDAQ: JBHT) 11.1% lower in after-hours trading on Thursday.

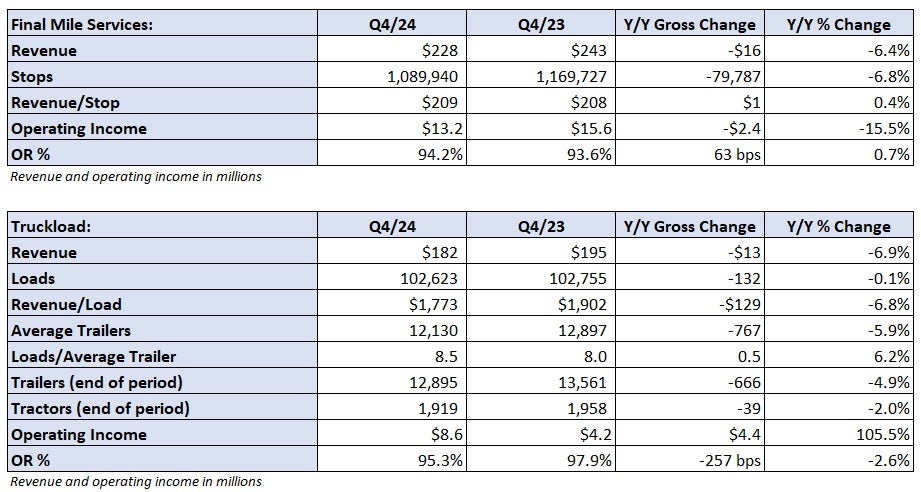

Operating income, margins and earnings per share in the following tables have been adjusted to exclude the one-off charges from the 2024 fourth quarter as well as $53.4 million in insurance-related items across various segments in the 2023 fourth quarter.

Intermodal volumes strong, waiting on pricing to turn

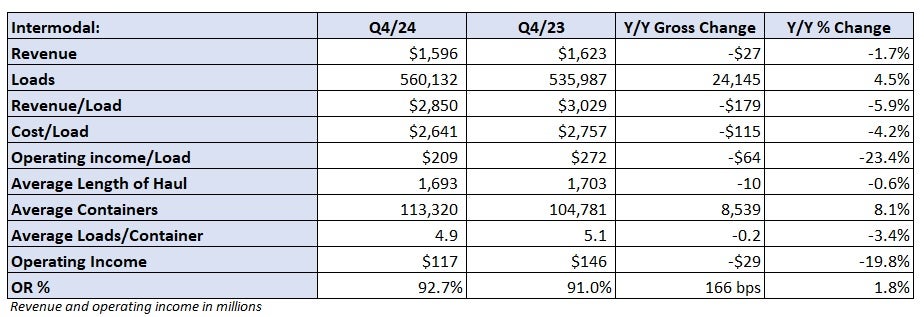

Intermodal revenue fell 2% y/y to $1.6 billion as loads increased 5%, but revenue per load was down 6% (down 3% excluding fuel surcharges). J.B. Hunt saw record volumes in the quarter with transcontinental moves up 4% and Eastern loads 6% higher even as the mode competed with low truck rates.

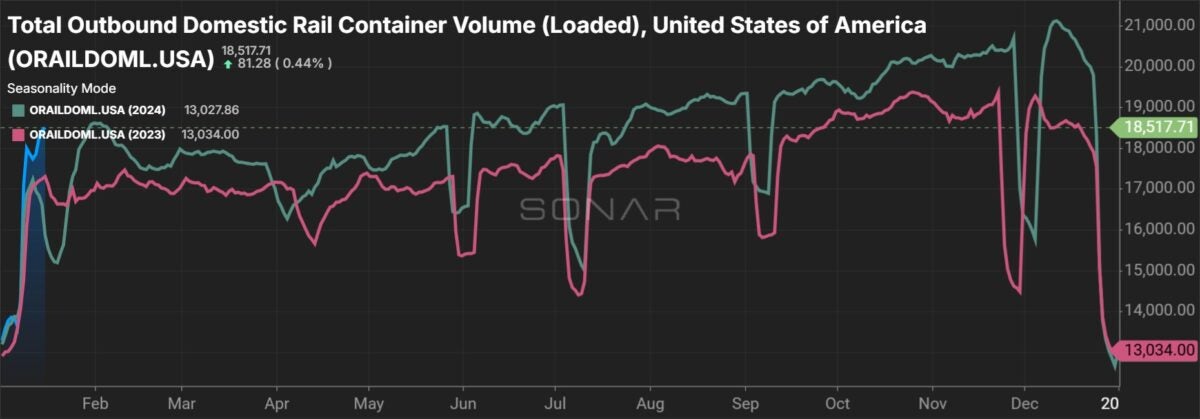

Total intermodal traffic on the U.S. Class I railroads was up 9% y/y in the quarter, according to the Association of American Railroads.

The unit recorded a 92.7% operating ratio (inverse of operating margin), which was 170 basis points worse y/y (70 bps worse excluding the prior-year insurance add-back). Costs associated with elevated volumes and repositioning equipment, as well as the addition of 800 intermodal drivers for peak season, were the headwinds.

Management said on a Thursday call that rail service at partner BNSF (NYSE: BRK.B) did decline for a couple of weeks early in the quarter, which weighed on margins. However, the recent service issues in the West are tied to record volumes and not structural in nature, management said.

Revenue per load stepped slightly higher sequentially for a second straight quarter, but pricing headwinds from recent bid negotiations will linger through the first half of 2025. The company said it has seen an improvement in customer bid compliance, and it is hoping to see rate increases on future bids to offset cost inflation.

J.B. Hunt said customer satisfaction was at an all-time high in the quarter.

Customer attrition in dedicated to end in Q2

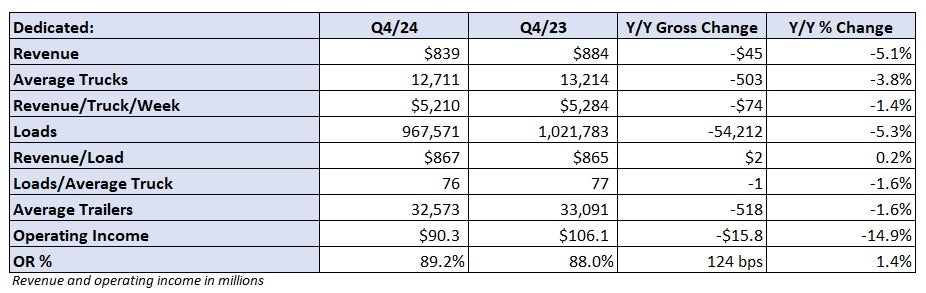

Dedicated revenue fell 5% y/y to $839 million as average trucks in service were down 4% and revenue per truck per week was off 1%. The company added 440 new trucks into service in the quarter (more than 1,700 for the full year), but the additions lagged attrition across customer accounts.

Fleet losses could continue through the early part of the second quarter, but the company expects to add 800 to 1,000 trucks net of attrition this year.

The segment recorded an 89.2% OR, which was 120 bps worse y/y excluding nonrecurring charges in the prior year. The company’s matured business, which excludes startup costs at new accounts, saw ORs between 86% and 88% and in line with a long-term target.

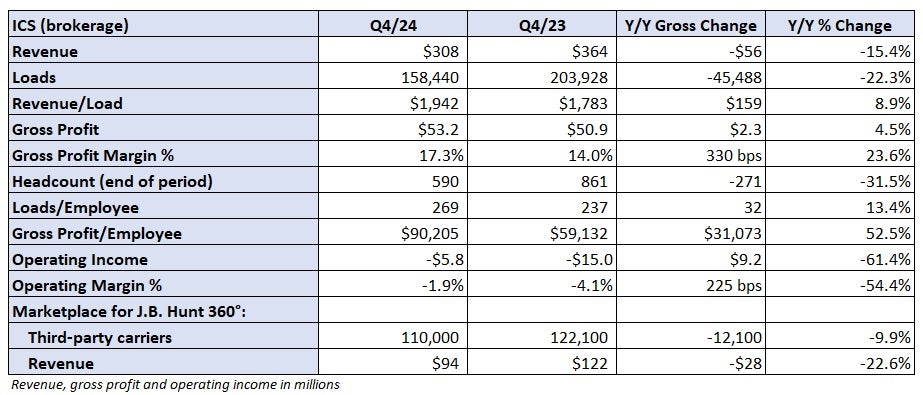

The brokerage segment saw revenue fall 15% y/y to $308 million as loads fell 22%, partially offset by a 9% increase in revenue per load. (Loads were up 7% sequentially with revenue per load 3% higher.) The unit cut costs, reducing head count by more than 30% y/y. However, it booked an operating loss of $21.8 million (a $5.8 million loss excluding the asset impairment charges, which in part were tied to the acquisition of BNSF Logistics’ brokerage operations).

Approximately $35 million in integration and impairment costs from the acquisition will not recur this year. The company is still looking to cut costs in the business.

J.B. Hunt was carrying $100 million in aggregate operating costs (depreciation expense and storage fees on equipment) tied to holding excess capacity in its intermodal and truckload units. That number now stands at $60 million.

More FreightWaves articles by Todd Maiden: