A new administration has been selected after this week’s long-anticipated presidential election has come to an end. Now that the results are in, what does that mean for the many renewable energy and sustainability initiatives that have progressed over the past four years, including the Inflation Reduction Act? Obviously, we don’t really know the answer, but we do know the attitudes of the incoming administration regarding environmental legislation and the support of fossil fuels. So here are some possible scenarios for the energy and process and discrete manufacturing markets. As we write this article, the fate of Congress is unclear, but a GOP majority in the Senate, Supreme Court, and Executive Branch could potentially allow for swift policy shifts regarding renewable energy policy and environmental legislation. A majority in all branches of government would leave little room for debate on policy. Over the last four years, the Biden administration invested hundreds of billions of dollars to support domestic energy transition efforts, including the Bipartisan Infrastructure Law and the Inflation Reduction Act (IRA). However, these investments — and the tax credits supporting them — now face uncertainty.

A new administration has been selected after this week’s long-anticipated presidential election has come to an end. Now that the results are in, what does that mean for the many renewable energy and sustainability initiatives that have progressed over the past four years, including the Inflation Reduction Act? Obviously, we don’t really know the answer, but we do know the attitudes of the incoming administration regarding environmental legislation and the support of fossil fuels. So here are some possible scenarios for the energy and process and discrete manufacturing markets. As we write this article, the fate of Congress is unclear, but a GOP majority in the Senate, Supreme Court, and Executive Branch could potentially allow for swift policy shifts regarding renewable energy policy and environmental legislation. A majority in all branches of government would leave little room for debate on policy. Over the last four years, the Biden administration invested hundreds of billions of dollars to support domestic energy transition efforts, including the Bipartisan Infrastructure Law and the Inflation Reduction Act (IRA). However, these investments — and the tax credits supporting them — now face uncertainty.

The Inflation Reduction Act

Since 2022, states with GOP leadership have received more than half of the $387.8 billion allocated through the IRA, including states such as Texas and Louisiana whose regulatory climates are more conducive to business due to fewer regulatory barriers, (e.g. limited public commentary periods for energy projects). Many GOP-leaning states offer advantages for clean energy projects, including established industrial energy infrastructure, ample land, and abundant natural resources. Just days before the recent presidential election, more than a dozen House Republicans urged Speaker Mike Johnson to preserve the clean energy credits within the IRA if the GOP maintains or expands its House majority. They argued that removing these credits could result in a “worst-case scenario,” as numerous companies have already begun projects based on the assumption that these credits would remain in place. Eliminating them, they contend, could waste billions of dollars already invested. Meanwhile, in 2024, 99 percent of all the new power generation capacity in the US was wind and solar. It’s cheaper and faster to construct, despite the Much of the new on-demand generation capacity, those plants that need to start up quickly in the event of a need for more power on the grid, are still gas fired turbines mixed with battery storage. This is also true for deep red states like Texas, which now has more wind and solar capacity than any other state in the union. This is the invisible hand of the market at work and this scenario will not likely change with the incoming administration.

Since 2022, states with GOP leadership have received more than half of the $387.8 billion allocated through the IRA, including states such as Texas and Louisiana whose regulatory climates are more conducive to business due to fewer regulatory barriers, (e.g. limited public commentary periods for energy projects). Many GOP-leaning states offer advantages for clean energy projects, including established industrial energy infrastructure, ample land, and abundant natural resources. Just days before the recent presidential election, more than a dozen House Republicans urged Speaker Mike Johnson to preserve the clean energy credits within the IRA if the GOP maintains or expands its House majority. They argued that removing these credits could result in a “worst-case scenario,” as numerous companies have already begun projects based on the assumption that these credits would remain in place. Eliminating them, they contend, could waste billions of dollars already invested. Meanwhile, in 2024, 99 percent of all the new power generation capacity in the US was wind and solar. It’s cheaper and faster to construct, despite the Much of the new on-demand generation capacity, those plants that need to start up quickly in the event of a need for more power on the grid, are still gas fired turbines mixed with battery storage. This is also true for deep red states like Texas, which now has more wind and solar capacity than any other state in the union. This is the invisible hand of the market at work and this scenario will not likely change with the incoming administration.

What About Tariffs?

Tariffs also play a central role in this administration’s economic strategy, a stance that dates back to their first term in 2016. Now in 2024, proposals include significant tariff increases on foreign goods to support U.S. manufacturing and job growth. Plans floated during the campaign suggested a universal tariff of 10% to 29% on most foreign products, a 60% tariff on Chinese goods, and the removal of China’s permanent normal trading status. A proposed “reciprocal” tariff would match the tariffs other countries place on U.S. goods.

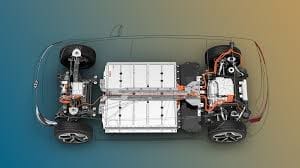

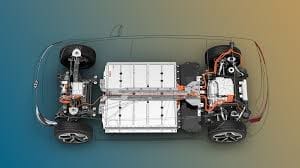

While tariffs are intended as taxes on goods crossing U.S. borders, importers often pass the costs onto consumers, potentially affecting U.S. manufacturers dependent on imported resources. China, a major supplier of electric vehicle (EV) batteries, could be particularly impacted by these tariffs, leading to increased costs for EV materials and pricing many consumers out of the EV market. Currently, the U.S. domestic supply chain for key low-carbon products, such as EV batteries and solar panels, remains insufficiently scaled to compete with foreign sources. Although tariffs may encourage domestic production, they could also increase costs for American manufacturers, reducing revenues.

While tariffs are intended as taxes on goods crossing U.S. borders, importers often pass the costs onto consumers, potentially affecting U.S. manufacturers dependent on imported resources. China, a major supplier of electric vehicle (EV) batteries, could be particularly impacted by these tariffs, leading to increased costs for EV materials and pricing many consumers out of the EV market. Currently, the U.S. domestic supply chain for key low-carbon products, such as EV batteries and solar panels, remains insufficiently scaled to compete with foreign sources. Although tariffs may encourage domestic production, they could also increase costs for American manufacturers, reducing revenues.

However, that picture is changing. In just the past couple of years, massive deposits of lithium, a key ingredient in EV batteries, have been discovered in the US. ExxonMobil also became a huge lithium producer in 2023 with the acquisition of 120,000 gross acres of the Smackover Formation in southern Arkansas, one of the most prolific resources of its kind in North America. The direct lithium extraction that will be used by ExxonMobil utilizes 2/3 less carbon intensity than conventional extraction methods.

The Fate of Electric Vehicles

EV sales continue to grow overall, and the US share of electric and hybrid vehicle sales increased in the second quarter of 2024. The new administration, however, could roll back emission regulations, which would likely decrease demand for EVs (outside of strong pro-EV states like California, which may go on their own while increasing demand for oil, gas, and combustion-engine vehicles. Additionally, policies on methane emissions may be revisited. Any changes to methane regulations could impact U.S. oil and gas exports, as international buyers increasingly prioritize products aligned with methane-reduction goals. A U.S. withdrawal from the Paris Agreement is also possible, which would likely slow international efforts toward a coordinated energy transition.

The Biden on the energy transition has been clear, highlighting the perceived economic benefits of focusing on traditional energy sources and support for clean energy. Nonetheless, the impact of the IRA’s clean energy investments over recent years shows the potential for economic opportunity across party lines. While the next four years will bring changes, the momentum behind the clean energy transition remains significant and difficult to ignore.

The Biden on the energy transition has been clear, highlighting the perceived economic benefits of focusing on traditional energy sources and support for clean energy. Nonetheless, the impact of the IRA’s clean energy investments over recent years shows the potential for economic opportunity across party lines. While the next four years will bring changes, the momentum behind the clean energy transition remains significant and difficult to ignore.

Will the LNG Export Boom Continue

Since Russia’s invasion of Ukraine in 2022, Europe has increasingly relied on international suppliers for fuels and oil, with the U.S. emerging as a leading supplier of LNG and crude oil. In 2023 alone, U.S. LNG exports to Europe surpassed $30 billion, accounting for two-thirds of all U.S. LNG shipments. This surge has contributed significantly to U.S. revenue and tax income. Meanwhile, European consumers have faced higher energy costs, which have accelerated Europe’s shift away from fossil fuels.

While European policymakers remain concerned about potential tariffs from the next U.S. administration, they aim to maintain trade relations with the U.S., especially given tensions in trade with China. However, if a tariff conflict were to arise, retaliatory measures on both sides could strain the U.S.-EU relationship. The U.S. should be cautious, as European buyers have alternatives for LNG, potentially forcing the U.S. to turn to more distant buyers like China, increasing shipping costs. Although U.S. LNG production is expected to remain robust, the risk of a trade dispute with major European customers poses challenges to sustaining the current export boom.

While European policymakers remain concerned about potential tariffs from the next U.S. administration, they aim to maintain trade relations with the U.S., especially given tensions in trade with China. However, if a tariff conflict were to arise, retaliatory measures on both sides could strain the U.S.-EU relationship. The U.S. should be cautious, as European buyers have alternatives for LNG, potentially forcing the U.S. to turn to more distant buyers like China, increasing shipping costs. Although U.S. LNG production is expected to remain robust, the risk of a trade dispute with major European customers poses challenges to sustaining the current export boom.

This incoming administration has campaigned on a strong opinion on not interfering in the Russian conflict. If the Russian invasion continues without U.S. support to Ukraine the conflict could have detrimental effects on an international scale. In terms of US fossil fuel export policies, the Russian economy will favor these policies. LNG purchasers such as Europe may not agree with the decisions of the new administration and could result in some consequences for U.S. LNG exporters.

Find the Orginal Article Here